The nonwovens industry has witnessed a number of technology shifts this year, driven by a need for advanced materials. Some of these were recently outlined by Pricie Hanna, founding partner of Price Hanna Consultants, at Hygienix 2017.

She focused on three nonwoven technologies: Spunbond/spunmelt; carded air-through bonded; and spunlaced.

Spunbond manufacturers said they were drawn to the digital and high-speed benefits of the RF5

Spunbond manufacturers said they were drawn to the digital and high-speed benefits of the RF5

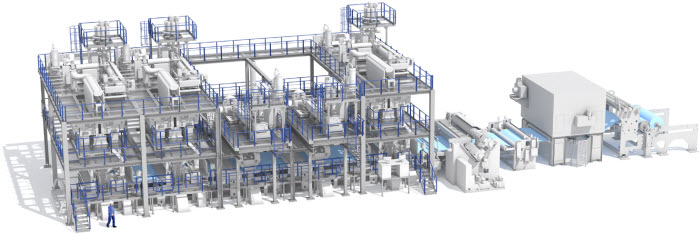

One of the biggest breakthroughs in the spunbond sector this year was Reifenhäuser Reicofil’s RF5 technology, an intelligent system that looks to drive the nonwovens sector towards Industry 4.0. Price Hanna Consultants surveyed leading spunbond providers to ask what they thought would be the main benefits of the new technology. Their main response was improved yields from the reduction of ‘hard spots’, increased resin throughput per beam – 30% higher than the RF4, and faster line speeds. Hanna says these factors are particularly valuable if the line is run at full capacity.

The digitalisation package of the RF5 is also of interest to manufacturers, particularly process and quality management which offers great potential for predictive maintenance. In addition, the finer filaments produced by the RF5 are also sought after as they contribute to improved softness.

According to Hanna, softness has improved dramatically by using many techniques that are “closing the gap between spunbond and the best carded technology softness”.

The spunbond sector is continually focusing on softness to rival that of carded air-through technology

The spunbond sector is continually focusing on softness to rival that of carded air-through technology

Such techniques include surface additives, finer denier filaments, blending in soft polypropylene (PP) resins, optimisation of calender bonding fabrics, and bicomponent PE/PP filaments – which she says is ‘an area of major investment around the world’. She adds that the industry has gone from sheath core bicomponent filaments to side-by-side filament configurations that provide even more softness and loft.

With the latter in mind, Hanna says techniques are being worked on to accomplish more lofty 3D nonwovens, especially within the otherwise flat spunbond/spunmelt material segment. Examples of this approach include Mitsui Chemical’s proprietary resin and extrusion technology; Reifenhäuser’s process for crimping fibres with hot knife for higher loft; First Quality’s process of hydroentangling cotton fibre and spunbond webs to create soft, fuzzy surface composites; and the bicomponent spinning of polyolefin resins with two different melt flow indices to form crimped fibres.

“When we talk to spunbond leaders, they also talk about seeking ways to effectively accomplish air-through drying and flat calender bonding to accomplish more lofty webs,” says Hanna. “While still maintaining the speed and cost advantages of the technology.”

She adds that we’re also seeing more true stretch in nonwovens, with spunlace a big platform for this. Examples include Suominen’s Fibrella Lite stretchable spunlaced facing for elastic components; Sandler’s sawaflex stretchable carded thermal bonded facing for elastic components; and Mitsui Chemical’s ISuper proprietary resin and stretch spunbond technology for diaper backsheet and side gathers for a gentle, snug fit.

Hybridisation of technologies is another growing industry trend. Hanna says that leading spunbond companies are coming up with ‘pretty exotic portfolios’ of different spunbond grades to offer silky smooth products and soft and fuzzy products, working with bicomponents. Avgol, for instance, has used hydroentangling on the surface of the spunbond to accomplish patterning. This can be seen in its Lux Fabrics, Dimple and Ultima Fabrics lines.

Skin health is becoming more of a focus for topsheets. Manufacturers are aiming to reduce skin contact by using more of a variable pattern. Kimberly-Clark’s Huggies Little Snugglers, for example, offer a topsheet with soft, ‘tiny pillows’ to help skin stay dry and healthy. Hanna says that more embossing is also being done for topsheets, an example being Kimberly-Clark’s Huggies Little Movers DryTouch Liner, which achieves faster moisture absorption through embossing patterns. This is another way of achieving a more 3D topsheet configuration, Hanna adds.

Huggies Little Snugglers diapers feature tiny pillows to keep skin soft and dry

Huggies Little Snugglers diapers feature tiny pillows to keep skin soft and dry

Meanwhile, Kao’s Merries skin-friendly topsheet is designed so that it doesn’t stick to skin while also being soft and fluffy. According to Hanna, this particular pattern is a target for imitation by numerous companies.

Creative concepts are also being seen within carded air-through bonded acquisition/distribution layers (ADLs). Belgium’s TWE, for instance, came up with Amphibia, an advanced product for fluffless pulp diapers. Its all-in-one design combines ADL with a superabsorbent polymer (SAP) impregnated fibre core structure. Hanna says another version of Amphibia is currently under development, comprising a multi-layered ADL with a core structure including SAPs.

Multi-layered ADLs, says Hanna, are designed to provide advanced capillary fluid management needed for diapers with a high SAP content of over 50%. Acquitex by Texsus SPA, for example, offers a multi-functional approach to provide even more effective fluid management. The high loft nonwovens ADL is developed with air-through bonded technology, and it has a SAP/fluff ratio core of more than 50/50.

Topsheets and backsheets are being designed with skin health in mind

Topsheets and backsheets are being designed with skin health in mind

In the spunbond sector, First Quality has also developed materials to address skin health, including Dri-Fit cotton enhanced – developed for the incontinence market. According to Hanna, a cotton web is hydroentangled with the spunbond for a ‘new level’ of protection and skin comfort in the topsheet and backsheet.

To take all these emerging technologies into account, Hanna says that cost should remain a major factor in planning. “In this intensively competitive hygiene industry, the affordability of these new generation nonwovens will determine the rate of market penetration in mature and emerging markets alike,” she says.

And, responding to the question of ‘what drives innovation?’ Hanna says: “With the competitive intensity of the industry, the demand for cost savings continues to be a clear driver. Number two is the need for greater competitive differentiation through design concepts. Three is the consumer’s perception of unmet needs and the ability of our industry to put possibilities in front of the consumers that can connect with their realisation of that need. If you are responding to those drivers, innovations will yield profitable market returns.”

Have your say. Tweet and follow us @FHaran_WTiN and @WTiNcomment

RELATED ARTICLES

-

DPPs: 5 key concerns for brands

- Otis Robinson

- WTiN

-

Wool Market Report

- Nitin Madkaikar

- WTiN

-

Performance apparel at Techtextil

- Sympatex

- WTiN

-

News Release

Digitalisation brings movement to sports sector

-

Fireside Chat

AI and automation at the Wearables Collective