Otis Robinson speaks with Laurent Dubuisson, vice president, client services, EMEA, and Christophe Therrey, vice president, sales, EMEAR at Centric Software about product lifecycle management (PLM) trends in the fashion industry.

During the Covid-19 pandemic, businesses have accelerated the adoption of product lifecycle management (PLM) solutions, says Christophe Therrey, vice president, sales, EMEAR of Centric Software, a Silicon Valley-based software company.

The solutions provider has a heavy footprint in the fashion industry, with luxury fashion brands such as Louis Vuitton, Balenciaga and Calvin Klein having adopted its PLM solutions in the past, but much of the sector remains tied to traditional means of product development. On the contrary, now that the Covid-19 pandemic has interrupted fashion trade beyond easy repair, PLM has fast popularised as a key tool for apparel and luxury garment companies.

According to Therrey, PLM has enabled business to continue in compliance with a new normal: it allows collaboration across the globe, the redesign of collections according to rapidly changing consumer interests, the reduction of travel and the introduction of better decision-making capabilities, all while offices close, social distancing rules strengthen and retail stores shut down completely. Today, for fashion businesses, PLM represents an advantageous move in the right direction in the middle of a crisis, and in particular, highlights a digital divide, Therrey says.

“If you look at companies who have not yet fully digitalised their product development environment, [you can see] those companies are struggling,” Therrey explains. “They are less agile than others; they take longer to make decisions and they are not able to work effectively in their current environments.

People are not allowed to go to the office anymore but are in a situation where they have to keep operating with the same level of productivity as before. If you don’t have a fully collaborative solution to manage that, [then] there is no way you can operate. You are stuck.”

Consequently, many companies have turned to PLM.

The digital divide

PLM helps to manage the multiple steps and stakeholders involved in product design, development, manufacturing, and distribution. The creation of a mainstream or luxury garment involves a lengthy process that begins with financial planning, through to the design phase, sourcing suppliers, costing, prototyping, production, quality control, delivery and more. These key cogs – required to create and sell a garment – are often dispersed so vastly throughout the value chain that when operating without a robust PLM system in place, companies can burn through a significant amount of time trying to collate data and organise these players into a coherent, streamlined process.

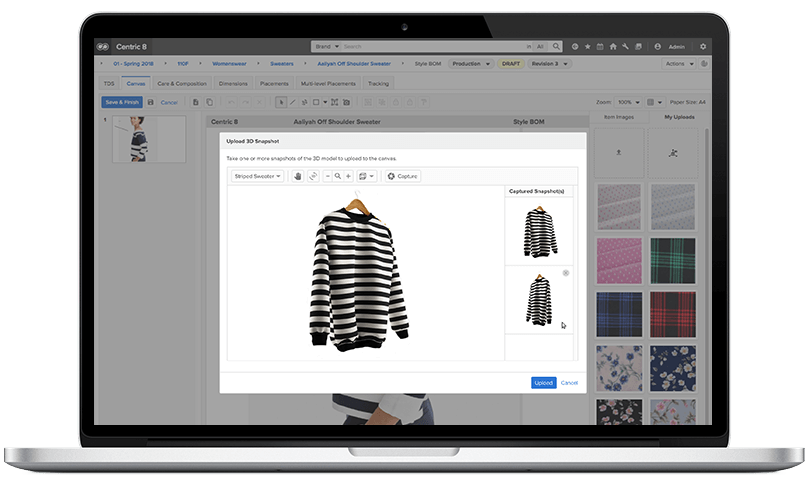

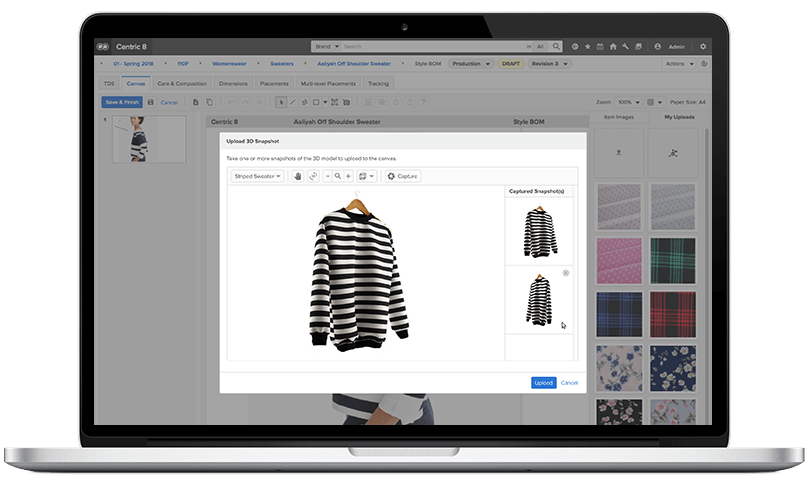

Most businesses remain tied to clunkily organised spreadsheets that are sent back and forth, Therrey says, but ongoing digitalisation offers an alternative. Taking the form of a centralised, web-based platform, Centric Software’s PLM system enables users to access information or amend data throughout product development, whether through a computer, tablet or mobile device. Centric’s vice president, client services, EMEA, Laurent Dubuisson, summarises that the platform opens up “everything that you need to do on the product to make it ready to be shipped into stores” in a single, interoperable space.

“It’s distributed,” Dubuisson says. “You can use it anywhere in the world, throughout the whole supply chain. It’s something that we try to make as easy as possible to access and use.”

The pair add that Centric’s approach to the design of its software is user-focused: customers seek an out-of-the-box solution with an agile approach and skilled consultants on-hand. Thus, Therrey claims Centric’s current PLM solution can decrease the time it takes for a product to be propelled to the market while solidifying efficient workflow for key stakeholders. Centric cites customers who have experienced this reduction in time to market: Amaro, Bestseller, Gant, Marc Jacobs and Nina Ricci.

Yet, despite the efficacy of PLM, Therrey explains that the apparel and luxury fashion industries have been slow to adopt these digital technologies.

Therrey cites one of Centric’s customers, a UK-based high-street clothing company, as a before-and-after example of the revolutionary effect a PLM system can have on processes. Previously, the brand had experienced a delayed process in getting a product to market; its process involved developing, redrafting, and updating the garments, resulting in a number of iterations of the same product.

“In order to create a new piece, a new style, a new product, it would take them anywhere from three-to-four months,” Therrey explains. “This is way too long. What they forgot was that they had already developed a similar product before.” According to Therrey, the brand had been keying in a lot of data in Excel, but after implementing PLM, “all they had to do was look at the old product they had developed” and make minor changes, bringing the product to the market much faster.

This acceleration is a key priority for most brands, particularly now that consumer buying patterns and fashion trends are changing during the pandemic. Centric says PLM solutions can help support brands as they try to survive continuous economic struggle.

“Products that were being developed before the Covid-19 pandemic didn’t sell, or [maybe] didn’t sell in the same way,” Therrey says. But by implementing PLM, brands can now quickly transform a collection or product to adapt to new consumer interests, or even prepare for the reopening of retail stores, he adds.

Unfortunately, according to Centric, many companies remain focused on craftsmanship and are eager to keep hold of tradition and manual work; this reiterates the digital divide that Centric has observed and highlights the instability of many businesses in the fashion sector who sit on the wrong side of the fence.

Cloud PLM

“It’s true that historically, these companies have been under the impression that they could live without a PLM solution,” says Dubuisson. “Firstly, they wondered about the benefits as they thought their products were simple and cheap, so thought, why invest? Secondly, they thought, ‘Why use a PLM solution for products with such a short lifecycle?’”

This resistance to new systems and the belief that PLM is unsuited to certain products has left some businesses and industries unable to catch up to the fast-developing digital divide, Dubuisson summarises. He adds that while it is possible to run a business without a PLM system, it is simply not as effective, as “you can concentrate on what you do best by putting great product on the market”. Thus, Centric claims to offer a somewhat innovative deployment approach that involves working with the businesses’ stakeholders on an adoption strategy to propose a system that is easy to use.

The increasing necessity for these digital solutions in an unprecedented period of human history is supported by further technological developments. Therrey says those on the right side of the divide – businesses that heavily embrace digital tools – are now pushing for software-as-a-service (SaaS) solutions, meaning PLM offerings are moving closer towards becoming solely cloud-based.

“We’re seeing a vast move to cloud PLM,” he says. “Two years ago, the systems that we were selling were mostly installed on the customer’s own IT infrastructure.

“Now, two years later, more than 80% of the customers we talk to require a full SaaS solution. This means we are responsible for everything; making sure the system keeps operating on their service level agreements, for example, from eight o’clock in the morning to eight o’clock at night, including weekends.”

Centric’s cloud-based PLM offering has attracted partnerships with esteemed brands within the fashion industry – for example, with a France-based luxury brand that required a continuous, remote system up-and-running during essential global fashion weeks. According to Centric, the capabilities of its cloud-based PLM solution exemplify the company’s move towards full digital mobility, which mirrors ongoing Industry 4.0 digitalisation in the fashion sector.

Digital mobility

Production, creativity, and capacity are constantly on the rise, which may suggest PLM is important for where the fashion industry and its players are headed. Therrey accredits growing productivity to tech giants like Apple, who led a trend in launching several products a year, and high-street giants that release micro-collections in addition to their main seasonal collections. To keep rapidly producing fashion items in this way, the use of PLM is paramount, he suggests.

“We need to provide solutions that enable those customers to accelerate their product development and shorten their time to market,” Therrey explains, later adding that Centric is witnessing “increasing demand for digital collaborative solutions to manage [these] processes”.

Thus, with PLM bridging the digital divide and helping businesses stay afloat, adapt, and rapidly respond to consumer trends, Centric claims it has further strides prepared for the future of lifecycle management.

Firstly, comes Centric VIP, which is designed for fashion, outdoor, luxury, consumer goods and retail businesses “looking to leverage fully collaborative, highly intuitive, cross-system and fully-connected technology”.

“[And] we are going to explore full digital mobility,” Therrey adds. “In our product portfolio, we have about 15 mobile applications which serve specific purposes at each step of the product development process.

“We’re now going to launch even more mobile applications, simply because people are constantly on the move, even more now.

“They need to be able to do their job and accomplish tasks remotely, wherever they are, independently.”

To find out more, visit www.centricsoftware.com.

Have your say. Join the conversation and follow us on LinkedIn