Open data from the apparel manufacturing industry has determined that thousands of Asia’s garment factories face complete submersion under rising sea levels by 2030. Otis Robinson reports.

The impact of Covid-19 on global supply chains prompted businesses to evaluate their exposure to naturally occurring supply chain disruptions. Western brands, which largely rely on longstanding relationships with outsourced manufacturers in Asia, realised that an overdependence on a single region or country would eventually prove detrimental – particularly now that natural disasters such as pandemics and unstable weather are a real and present danger.

For industry, more unavoidable natural disasters fast approach as climate change worsens, and data is required to identify and communicate these risks. In October 2021, it was reported that thousands of Asia’s garment factories must relocate to higher ground or risk complete submersion by rising sea levels by 2030, according to new research.

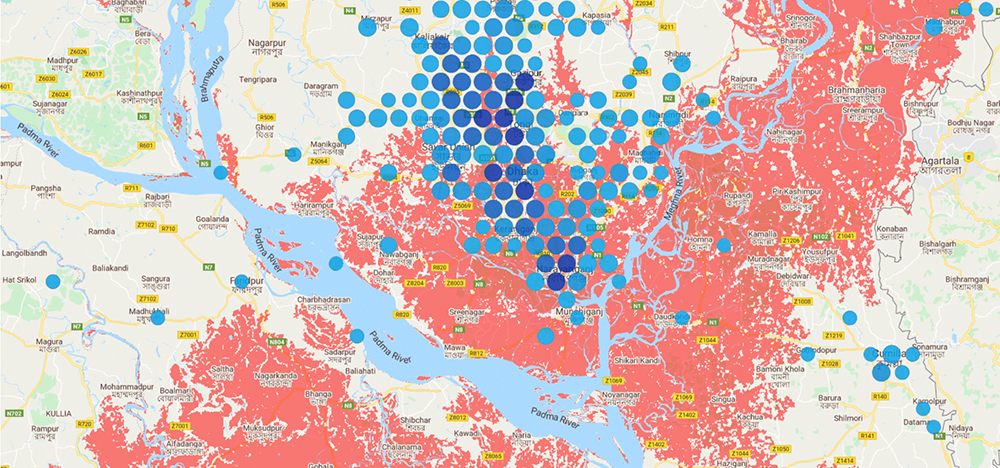

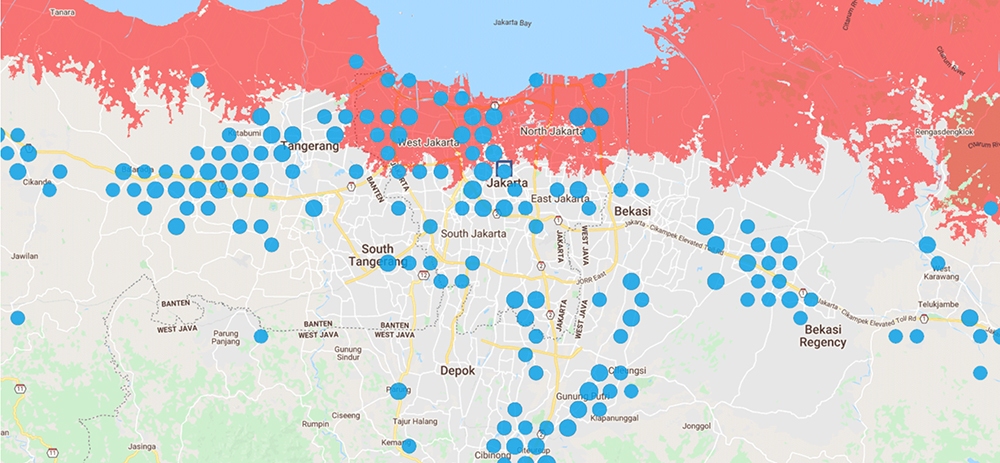

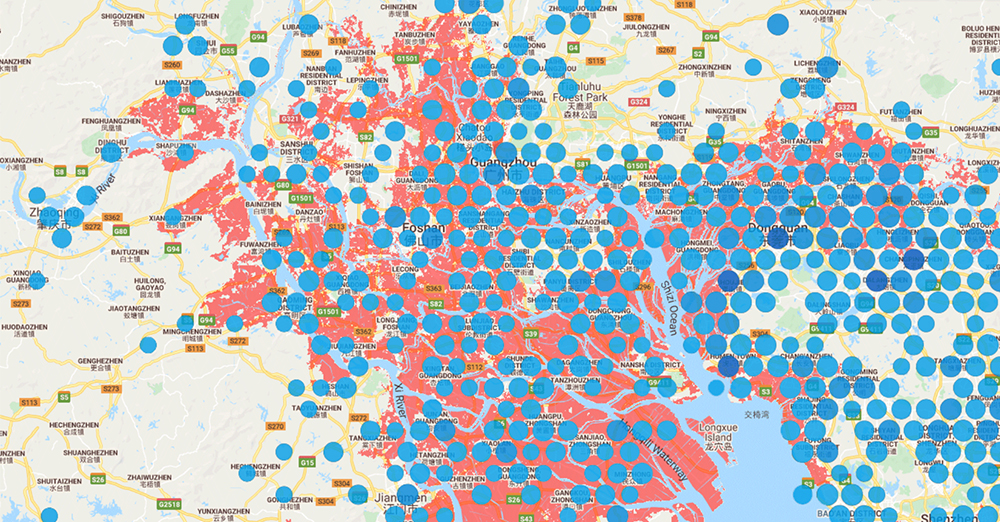

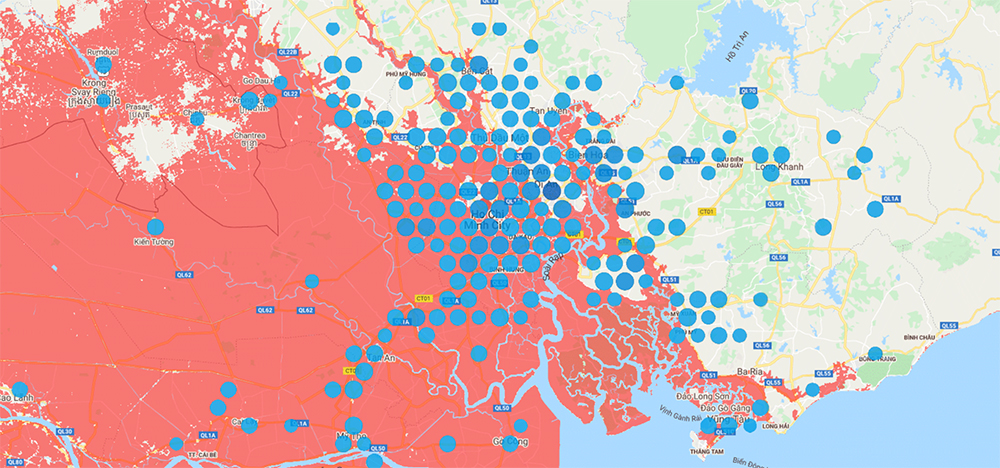

The findings, conducted by researchers from Cornell University in the US, utilised textile & apparel industry data from the Open Apparel Registry (OAR), an open-source factory database. Researchers overlaid a map of factory locations from the database – hubs in Jakarta, Phnom Penh, Tiruppur, Dhaka, Guangzhou, Columbo and Ho Chi Minh City – onto data detailing where elevations will fall below the level of coastal floods at an average of once a year by 2030. The team then determined which apparel-producing regions are under threat from climate change.

Climate change

Referring to recent disruptions to travel to Glasgow in the UK, Katie Shaw, chief programme officer at the OAR, says: “We’re seeing more extreme weather events and they’re happening on our own doorstep.”

In early November 2021, commuters heading to the 2021 United Nations Climate Change Conference (COP26), held in Glasgow, faced travel disruptions related to severe weather. Torrential rain and 80 mph winds interrupted UK public transport infrastructure and, ironically, left attendees of COP26 stranded or unable to make their way to the event. To many, the irony was a stark reminder that climate change is ‘right at our doorstep’ in the western world. Additionally, reports show climate change disproportionately affects lower-income countries, meaning Western brands that source from Asian manufacturers could soon feel the effects of climate change disruptions in their supply chains. The Cornell University findings show a point-of-no-return may be inevitable.

Shaw adds: “I think we’ve reached a point where we can’t completely eradicate the short-term impacts of climate change, but we absolutely need to think about those longer-term impacts and how to prevent it from getting significantly worse.”

Ultimately, the Cornell University research illustrates the potentially bleak, irreversible reality of climate change and the immediate gambles that must be made for Asian garment manufacturers to survive. Rising sea levels present a huge risk to businesses: many garment manufacturers may be forced to make costly relocation decisions, while others in less financially capable positions could face flooding of their operations without an escape route.

Elsewhere, up the supply chain, Western brands themselves may be concerned about the potential loss of their supplier factories, supply chain disruptions or their own responsibility in helping to support Asian garment manufacturers. For example, the findings strengthen pressures on industry to mitigate or curtail its impact on the environment, says Shaw, which means a solution may require a collaborative effort between brands and suppliers.

Nearshoring

Shaw notes that going forward, as organisations look at the geographics of their global supply chains, sourcing decisions may evolve in support of nearshoring or reshoring. Particularly in the case of the Cornell University findings, nearshoring could be one solution that alleviates brands’ worries.

Nearshoring – the act of bringing production closer to home or the consumer – has danced at the periphery of industry conversation for some years. According to research conducted by McKinsey in 2019, 63% of respondents believed it is likely that textile industry fabric production would move towards nearshore to support regional supply chains by 2025. This would be a bold move that faces high barriers but now holds unprecedented potential in the aftermath of Covid-19, whereby supply chains began to break down and suffer gargantuan interruptions. It is likely that this new research by Cornell University could encourage or reignite brand interest in the nearshoring movement to avoid future disruption due to rising sea levels.

But Shaw says that brands nearshoring their production would work at the detriment of loyal garment manufacturers. Again, Shaw suggests, a collaborative effort could be beneficial for all parties.

She explains: “We’re going to have to ask some deep and challenging questions. How can dynamics in supply chains shift so that brands are working together with their supplier factories to think about the [environmental] impact that this research has revealed? How can they work together to mitigate those impacts and think through the potential relocation of factories?”

Although Shaw does not presently hold the answers to these questions, she notes that the findings, which utilised data by the OAR and think-tank Climate Central, showcase the imperative nature of open data to identifying and preparing for climate- and sustainability-based bottlenecks.

Data availability

The use of data to support the optimisation of textile & apparel industry supply chains has popularised, particularly as part of the Fourth Industrial Revolution. The aptly titled Industry 4.0 encourages data acquisition and transparency to forge stronger connectivity in the supply chain.

The OAR, a non-profit organisation, offers a tool to industry that maps garment facilities worldwide and allocates a unique ID to each, allowing brands, organisations, factory groups, multi-stakeholder initiatives and schemes to contribute to and view garment facility data publicly. The organisation also aims to improve data quality in the garment industry by addressing data-related challenges such as standardisation, data availability, cleaning, matching and connecting disparate datasets, but its specific focus lies in the open availability of information.

Shaw believes attitudes to publicly accessible data have changed. For example, the OAR is in the midst of developing an extension to the tool titled Extended Profiles. This will cater to new demand for extended datasets. Shaw notes that many brands now seek information on number of workers, on parent companies and on types of product manufactured, among other datasets, particularly as brands are taking more responsibility in enhancing their supply chain transparency. Today, movements such as the Transparency Pledge Commitment have swept the industry.

Shaw explains: “Industry is ready to share additional data points about facilities. We’ve had increased requests to display additional data per facility. There is also a lot of interest in understanding what type of processing is happening at a facility that will impact things differently, whether that is social or environmental impacts at a facility level.”

Since industry now recognises how valuable open data can be for the betterment of the supply chain, the OAR intends for the Extended Profiles feature to launch very soon – in February 2022.

In the meantime, the OAR’s case studies exemplify how wielding data can support positive social and environmental impact. Brands such as Mammut and Katmandu are utilising the OAR platform to collaborate with factories. Civil organisations such as WageIndicator and the Business and Human Rights Resource Centre have used OAR’s data to help with their advocacy work. Meanwhile, it allows other organisations to prioritise where to target and install programmes in specific garment manufacturing areas. Now, the data has been used to identify at-risk areas of rising sea levels.

Ultimately, the findings and subsequent action points exemplify how data and data transparency can be used to inform decision making in the garment industry. The use of OAR data in the Cornell University research is said to “demonstrate the use cases for open data and the potential for it to inform critical decisions around policy, investment, sustainability and ESG initiatives in the fashion sector, globally,” says a company note. The OAR has also published a range of use cases for its data in a report titled From Opaque to Open: Untangling Apparel Supply Chains with Open Data.

Shaw adds: “By opening up datasets [we can make] them freely accessible for anyone to make use of – whether it is researchers like the team at Cornell or global brands or civil society organisations – and the open nature of our data is what is really powerful.”

Jason Judd, executive director at Cornell University’s Industrial and Labour Relations (ILR) School, says the findings will be delivered to Asian audiences at the Sustainable Apparel Coalition in November 2021.

Judd concludes: “A deeper analysis of these trends – we expect to produce this in mid-2022 – will be shared widely and in Asia among suppliers, workers and governments as well as investors in Asia, Europe and the US.”

For more information visit www.openapparel.org or www.ilr.cornell.edu.

Have your say. Join the conversation and follow us on LinkedIn