-

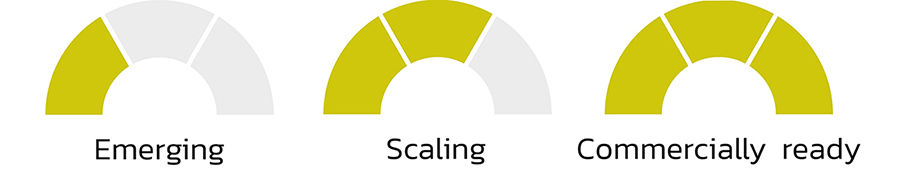

Understanding the commercial readiness scale

WTiN’s Commercial Readiness Scale gives an indication of what stage of commercialisation a product is at. It ranges from Emerging: a research stage development; Scaling: the product is being produced on a small but growing scale, and Commercialised: the product is well-established and ready to purchase.

Sponsored by BASF

Dr Dag Wiebelhaus, head of Product Innovation, BASF discusses the company’s technology behind loopamid, the first recycled polyamide 6 made entirely from textile waste.

The textile market is currently awash with claims of recycled materials, but so few of them are truly circular. Enter Germany-based BASF with its loopamid technology. The company has created the first recycled polyamide 6 (PA 6/nylon 6) made entirely from textile waste and can be recycled itself, making a complete textile-to-textile recycling closed-loop.

Developing the technology, Dr Dag Wiebelhaus, head of Product Innovation, BASF notes has been challenging, with textile waste being “such a complicated feedstock.” He continues: “Before we started, there was no technical solution to actually do that. People were able to blend a little bit of textile feedstock into their feed if they do a chemical recycling, but just using textile waste was impossible.”

A major part of the challenge, according to Wiebelhaus, is that many PA 6 garments are made with spandex: sportswear, intimates and swimwear, for example. As a result, the spandex and PA 6 “cannot be separated mechanically because they are interwoven. Therefore, for recycling, you must have a process that can tolerate spandex or elastane.” He adds this was the main technical challenge the company needed to solve and now, BASF can “digest any mixture and extract the PA 6 and bring it back to virgin quality.”

So, as the technology can work with all materials and blends, textile-to-textile recycling, over several cycles is now possible – using industrial textile waste and post-consumer textile waste. And importantly, Wiebelhaus claims, loopamid’s properties are identical to traditional PA 6.

Creating an infrastructure

After originally targeting post-consumer waste in Europe, the company hit some roadblocks. Wiebelhaus notes the loopamid team was working with virtually all of the collectors in Europe” – of which there aren’t that many. “There's an established system for collection, and we've been in contact with all of them. But they are all mainly sorting for reuse.” Thus, they are not sorting by fibre type – and this is what is required for closed-loop recycling.

Wiebelhaus explains: “You need to separate by fibre: polyester, polyamide, cotton, wool and so on. And the scaling is still going on in Europe.” With the European collection and sorting infrastructure not quite ready, BASF has built its first loopamid facility in China where there is a lot of garment production – and therefore a lot of waste “from the last step of the value chain, which is called ‘cutting table waste’ or ‘cutting’ waste.” Wiebelhaus continues that this waste has the same complexity as post-consumer waste as it is already interwoven with other materials such as spandex and has been through coloration and finishing stages. He says: “It's a lot of waste that doesn't find a good use today and is more easily accessible.” With multiple streams available in the region, BASF is currently using post-industrial cutting waste and post-consumer waste as feedstock for loopamid. “We have actually been working closely with partners in China building up that supply chain. We take in the material after it's sorted and made into a compacted form, like pellets, and that is done with partners in China that know how to do this,” says Wiebelhaus.

Why PA 6?

When it comes to recycled materials, it’s commonplace for companies to begin their developments with the most commonly used materials – in the case of textiles & apparel, these are polyester and cotton. However, BASF has started with the more challenging PA 6. The main reason for this, according to Wiebelhaus, is that, as a supplier of virgin PA 6, they not only know the market very well but also “feel sort of responsible for the waste that is generated out of our material.” At the same time, thought, he adds, “we're also convinced that polyamide 6 is, for many applications in textiles, the best material to use if you compare it to other synthetics.”

For example, in comparing it to polyester, he says its mechanical properties are much better, giving it higher durability. “If you look at longer lasting garments, you should always prefer polyamide over polyester.” But polyester has a simpler chemical process for production and is therefore cheaper. However, when it comes to recycling the process is the very similar. “If you start from a textile waste that already contains the polymer, so polyamide 6 or polyester, then in both cases you only need to go one step back and then repolymerise – this technology is called depolymerisation.” Wiebelhaus continues: “The process is even easier for us with polyamide 6 because we only have one monomer, that needs to be purified.” Thus, eventually, with scale costs should come down. And Wiebelhaus summarises: “In a circular world in textiles, polyamide should play a much bigger role than it does today.”

Costs

When you compare recycled materials to virgin, the scale, Wiebelhaus notes, is so much smaller – especially when it comes to chemical recycling and the preparation of feedstock. In the development of synthetic virgin materials, “all the chemical processes are scaled, they're really big and very mature. Also, the raw material in that case, is crude oil which is very well developed.” He contrasts: “In our case, the waste collection and sorting – our raw material – is not scaled, and our own process is also not scaled.” However, once those processes come to scale, and these recycled materials have gone “along the same learning curve as its virgin counterparts many years ago, then cost will come down dramatically and eventually could also be on a similar level. Indeed, the pricing should also be less volatile as the feedstock will remain stable, unlike other fibre pricing that can be particularly variable.

This, though, will take time. Wiebelhaus says that at the moment, with the amount of manual work that goes into the recycling process, one cannot compete price-wise with the production, shipment and logistics of crude oil. “It will need to scale and take some time but the cost, he is sure, will come down. “That's a phenomenon that you observe with all new technologies all the time.”

And with BASF being such a large company, it is perfectly placed to develop the level of scale required. “We not only have the big advantage of a large chemical company that we have financial stability but we also have the in-house experience to scale these type of processes from the lab to a fully industrial, commercial scale.”

Unfortunately for many start-ups in the industry, that are developing promising innovation in the lab, can struggle to scale and not just because of the sheer amount of financial investment needed but the scale of the equipment etc that can bring completely new challenges, Wiebelhaus says. But for BASF, it’s part of its day-to-day. The endorsement of BASF in true circular materials is therefore promising for the wider industry and infrastructure development.

What’s next?

The loopamid team currently has a small plant in China that is operating continuously. However, the company is already evaluating where to put the next plant – and when.

“Feedstock availability will play a big role in this decision,” says Wiebelhaus. “But we're currently scaling with the plant that we have, seeing the feedback from brands we are working with and then we'll take the decision for the next step.”

For more information on loopamid visit: www.loopamid.com/

And to view the presentation from Textile & Apparel Circularity Week on-demand, visit: On Demand | Textile and Apparel Circularity Week

Have your say. Join the conversation and follow us on LinkedIn