-

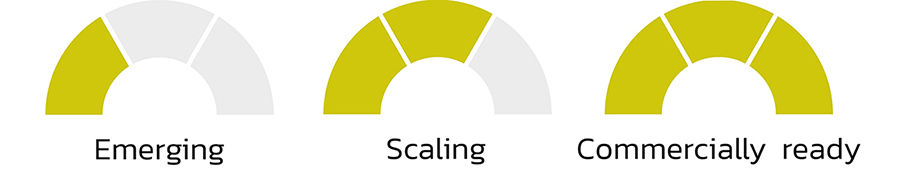

Understanding the commercial readiness scale

WTiN’s Commercial Readiness Scale gives an indication of what stage of commercialisation a product is at. It ranges from Emerging: a research stage development; Scaling: the product is being produced on a small but growing scale, and Commercialised: the product is well-established and ready to purchase.

Sponsored by Zhejiang Haiyin Digital Technology

Zhejiang Haiyin Digital Technology owner Lina Song talks about the future of digital textile printing in China, the role of single-pass direct-to-fabric solutions, and the challenges and opportunities facing industry stakeholders.

1. How and why are large-scale textile printing plants in China transitioning from traditional printing methods to digital printing?

Why

The shifting international landscape, coupled with declining consumer demand, has led to a gradual relocation of global manufacturing away from China – resulting in a steady drop in orders for Chinese enterprises. When production capacity far outstrips demand, competition between enterprises has become unprecedentedly fierce; a single Chinese character, “卷” (meaning “cutthroat competition”), perfectly captures this scenario. Such extreme competition has ultimately forced enterprises to pursue transformation and upgrading.

Digital printing, with its advantages of small-batch production, multi-lot flexibility and fast delivery, aligns perfectly with the current market’s demand for personalisation and rapid responsiveness. In contrast, traditional printing requires time-consuming plate-making, generates heavy pollution and incurs high costs. Beset by both environmental pressures and fragmented orders, traditional printing is no longer sustainable. Transitioning to digital printing is therefore not merely a technological upgrade, but a necessity for survival. This shift enables enterprises to adapt flexibly to volatile markets, reduce inventory pressure and minimise resource waste.

How

Since last year, the number of newly installed rotary screen printing machines in traditional printing and dyeing enterprises has plummeted, while purchases of digital printing equipment have continued to rise. Many enterprises have transformed their idle traditional production lines into digital ones: some have experimented by adding small-scale scanning printing devices first, while others have removed flat screen or rotary screen printers and directly installed single-pass production lines.

2. What is driving the high demand for single-pass inkjet printing among Chinese textile manufacturers?

Compared with textile printing plants in other countries, Chinese printing factories’ core competitiveness lies in three pillars – large production volumes, low costs and (for some plants) high quality (in fact, Chinese printing factories cover a wide range of quality positioning globally, from low to high-end). These three factors are like the “three sides of a triangle”: to remain competitive amid transformation and upgrading, enterprises must constantly prioritise them.

Single-pass inkjet printing technology, with its high speed, maximises the retention of traditional advantages (large volumes and low costs) while enhancing responsiveness and flexibility. Eliminating the need for order or screen changes, its comprehensive production efficiency (daily output) can reach 1–2 times that of traditional rotary screen printing and 10–20 times that of multi-pass digital printing. Meanwhile, it significantly reduces unit energy consumption and labour costs.

Against the trend of fragmented orders, the on-demand production model promoted by fast-fashion platforms like SHEIN has forced upstream printing and dyeing factories to improve responsiveness and small-order handling capabilities. Digital printing – with its advantages of no platemaking, fast screen changes and high colour reproduction – has become the preferred solution. Single-pass technology balances large-scale production with personalised demand, serving as a key technical pillar for reshaping competitiveness. This shift from “manufacturing” to “smart manufacturing” is redefining China’s position in the global textile value chain.

For owners of traditional printing enterprises, transformation entails dual pressures of risk and cost. However, the maturation of single-pass technology in recent years has made this transition more feasible: improved equipment stability, lower ink costs and gradual process optimisation have shortened the return-on-investment cycle. Enterprise owners particularly value its continuous production capacity and compatibility with existing production lines – enabling them to take on small orders for market testing while quickly switching back to large orders to secure profits. This “offensive and defensive” flexibility has greatly lowered the threshold for decision-making.

Policy support has also fueled the transition. The (Chinese) government’s tightening of environmental emission standards has accelerated the phase-out of high-energy, high-pollution traditional processes. As a clean production technology, single-pass inkjet printing drastically reduces water and chemical usage, as well as wastewater discharge, thus facilitating the shift to greener manufacturing.

From another perspective, compared with multi-pass digital printing equipment, single-pass technology is more compatible with traditional printing management models. Enterprises can achieve a smoother transition in terms of staffing, pre- and post-process supporting technologies and operational habits. Operators do not need to completely restructure production processes to realise a gradual upgrade from traditional rotary screen printing to digital inkjet printing. This technical path preserves the value of existing production lines while reserving interfaces for future intelligent upgrades.

3. Can you explain what advantages your single-pass, direct-to-fabric printers bring to large-scale operations?

Beyond the basic advantage of speed mentioned above, Hiink recognised from the project’s inception that single-pass technology could only replace traditional printing if it could replicate traditional printing patterns while leveraging digital advantages.

Large-scale customers prioritise stability and consistency under high quality – pure speed improvements cannot fully meet their needs. Quality, finished products, production capacity and usability are all indispensable – and these are exactly what Hiink delivers to customers.

Speed

During peak seasons, the average daily output per machine reaches 90,000 linear metres, with monthly output exceeding 2.8 million linear metres.

Quality

- Solid-colour patterns: Hiink’s single-pass technology transcends the limitation of only handling large, low-quality, or small-pattern orders. Through high-precision inkjet and intelligent colour management, it enables stable mass production of orders requiring complex patterns and high colour accuracy. Traditional printing’s reliance on layered solid colours has shaped a fixed aesthetic paradigm among designers for years. While single-pass technology’s high flexibility unlocks greater creativity in pattern design, designers still need time to adapt to digital expression logic – especially during the transition period. Hiink therefore identified that resolving the issue of print uniformity for large-area solid-colour patterns was key to gaining the trust of traditional customers. By optimising nozzle layout, ink droplet control algorithms and integrating hardware-software improvements (e.g., optimising control systems and operation software), it has significantly enhanced the printing uniformity of large-area solid colours.

- Three-dimensional effect: Samba print heads from Fujifilm produce smaller ink droplets with multi-level grayscale, resulting in smoother gradient colours, sharper edges and a more vivid, three-dimensional visual effect. Additionally, the high-frequency response capability of Samba print heads ensures precise placement of micron-level ink droplets, further enhancing image layering and detail expression.

- Brightness: Due to differences in printing principles, digital printing outperforms traditional printing in detail expression and colour transitions but struggles to match the latter’s colour vibrancy and saturation – especially for large-area dark colours, which tend to appear dull. Insufficient black depth also reduces visual impact. To address this, Hiink optimised ink formulas and printing parameter matching to improve ink deposition capacity per unit area. Combined with substrate pre-treatment technology, this significantly enhances colour fastness and saturation – making blacks deeper and bright colours more vivid. This successfully bridges the visual texture gap between digital and traditional printing, meeting the dual demands of high-end orders for brightness and colour intensity.

Cost

Hiink Kun single-pass printers, equipped with Samba print heads that support open waveform files, allow Hiink to adjust waveform files to achieve superior printing results while significantly reducing unit ink consumption. Under the premise of ensuring high precision and coverage, this effectively controls consumable costs: the average ink cost is 30% lower than that of other digital solutions, providing a highly competitive cost advantage for large-scale production. Including equipment depreciation, the comprehensive operating costs of some factories are lower than those of rotary screen printing.

- On-line sizing technology: In 2021, Hiink introduced on-line sizing technology, integrating the sizing step before printing. This improves fabric surface tension and ink adhesion: by printing immediately while the fabric is in a moist state, ink is effectively absorbed into the fabric fibres, enhancing colour saturation and overall print quality. Eliminating the need for drying also reduces energy consumption and processing steps, cutting comprehensive production costs by over 15%.

Usability

Born from a printing factory background, Hiink deeply understands user pain points. Hiink Kun is designed based on real market needs – from user-friendly operation interfaces that align with traditional habits to exceeding basic speed requirements. Enterprises need to further improve production efficiency and stability: when Hiink Kun operates with near-zero failure rates, sampling becomes as simple as mass production, enabling users to achieve seamless switching and drastically shorten delivery cycles. By matching the production speed of rotary screen printing, it supports 24/7 continuous production, delivering 1.5–1.8 times the daily output.

4. You project that your printers have produced 700 billion square metres of China’s total direct-to-fabric output in 2025 – what is Hiink’s share of China’s direct-to-fabric printing market in terms of output and installations?

In terms of single-pass installations, as of 16 September this year, Hiink accounts for 47.6% of all domestic single-pass equipment, according to the China Printing and Dyeing Industry Association (CDPA). However, this figure includes equipment that is actually out of service or nearly obsolete (due to technical immaturity, ageing, or other issues). Among active equipment, competitors’ machines have an average annual output of 5-7 million linear metres, while Hiink’s equipment achieves an average annual output of 10-12 million linear metres (with the highest-performing machine reaching 18–20 million linear metres annually). This means Hiink leads not only in installation quantity but also in actual production efficiency, demonstrating significant technical stability and large-scale production capabilities.

According to estimates by the CDPA, China’s domestic digital textile printing output will reach 5.013 billion meters in 2025, including 1.5 billion meters of direct-to-fabric digital printing. Hiink’s statistics show that as of 30 September, the cumulative actual output of all Hiink Kun machines reached 380 million linear metres - expected to hit 500 million linear metres by the end of the year. This will account for approximately 30% of China’s total direct-to-fabric digital printing output, making it the industry leader.

5. From a technical standpoint, what sets your single-pass printers apart from others in China?

Hiink Kun SP outperforms other similar products in order handling capability by delivering optimal printing results for complex patterns, high-precision multi-colour designs, simple solid-colour patterns and gradient-colour orders alike.

- Ease of operation: Employees can master the equipment quickly, reducing factory management costs. The intuitive operation interface allows new employees to operate independently after short-term training, greatly reducing labour dependence and error rates. The equipment operates in a stable manner and is easy to maintain, effectively ensuring continuous production.

- Color performance: Hiink’s single-pass inkjet system excels in colour consistency and smooth transitions. Even at high speeds, it maintains high-precision reproduction, solving common industry issues like colour deviation and ink breakage.

- Cost and durability: Independent research and development (R&D) of nozzle protection technology and intelligent ink supply systems significantly extends the service life of key components and reduces downtime. Additionally, ink costs are approximately 30% lower than other single-pass solutions, while printing quality remains more stable – boasting high colour yield and good batch consistency.

6. What are your customers increasingly demanding from single-pass direct-to-fabric printers?

Efficient sampling solutions: When considering purchasing Hiink Kun SP, customers often struggle with high-frequency sampling, and balancing sampling efficiency with mass production has become a core pain point. To address this, Hiink launched an intelligent sampling mode, which enables fast interleaved printing of fragmented small-batch sample fabrics without disrupting mass production rhythms. This drastically improves sampling efficiency: sampling no longer requires downtime or wastes production capacity but becomes an efficient part of the production process.

Diversified application solutions: Many customers seek more application solutions, particularly for functional fabrics and eco-friendly processes. Hiink has launched pigment digital printing solutions that support efficient printing on blended, polyester and natural fibres – eliminating the need for steaming and washing, which significantly reduces energy consumption and wastewater discharge.

Wider printing width: Customers are demanding wider printing widths to improve production efficiency and adapt to more textile categories. In the fourth quarter of 2025, Hiink launched wide-width equipment with a maximum printing width of 2.6 meters – meeting the efficient production needs of wide-width scenarios such as home textiles and outdoor products. By optimising nozzle layout and ink supply systems, the equipment maintains high-resolution output (600×600/900/1200 dpi) even for wide-width printing, effectively ensuring image precision and colour uniformity.

7. Are new business models, such as on-demand manufacturing and personalisation, impacting demand for single-pass printing in China?

The pandemic accelerated changes in consumption patterns and the rise of ecommerce, driving significant growth in demand for personalisation and small-batch customisation. This has pushed the entire printing supply chain toward flexible, intelligent production. Fast-fashion brands like SHEIN have demonstrated strong market responsiveness, and their “small-order quick-response” model has placed higher demands on the supply chain.

Hiink Kun SP exhibits exceptional flexibility and efficiency in handling small-batch, multi-lot orders – aligning perfectly with SHEIN’s need for rapid responsiveness and supporting the fast conversion from design to finished product. After many Hiink users became core suppliers to SHEIN, the ecommerce giant invested in Hiink Digital and became its strategic partner. This not only strengthens Hiink’s technological synergy and supply chain integration capabilities in fast-fashion digital printing, but also marks a new milestone in the integration of “Made in China 2.0” with global ecommerce innovation. Leveraging SHEIN’s deep understanding of flexible, quick-response supply chains, Hiink will further optimise the data closed-loop from design to production, enhancing responsiveness to small-to-medium batch, multi-lot orders.

8. How does your technology help customers improve sustainability compared to traditional methods?

Compared with traditional printing, Hiink Kun SP reduces chemical consumption by over 70% and cuts water and energy consumption by approximately 50% in the printing process, lowering pollutant emissions in printing and dyeing. Through precision inkjet control and plate less printing technology, it enables on-demand ink supply, avoiding resource waste associated with traditional plate making.

Additionally, Hiink’s pioneering on-line sizing technology integrates sizing and printing into a single process, reducing fabric transportation and repeated processing. By eliminating the drying step for sizing, it lowers energy consumption and improves efficiency—further enhancing sustainability.

9. What textile applications or end markets are benefiting most from single-pass direct-to-fabric printing?

While small-order quick-fulfilment orders currently dominate digital printing demand, Hiink believes single-pass technology’s greatest potential lies in driving in-depth transformation of the entire textile industry chain. From apparel to home textiles, and from fashion items to functional fabrics, single-pass direct-to-fabric technology is breaking the constraints of traditional production models, enabling efficient, green and flexible end-to-end upgrades.

For traditional printing enterprises specialising in apparel and home textile fabrics, single-pass direct-to-fabric technology reduces reliance on highly skilled labour, shortens production cycles and improves order responsiveness. Currently, single-pass technology has achieved stable mass production in mainstream application systems (reactive, disperse and pigment inks), though it is rarely applied in special processes such as acid or vat dyes.

10. Demand for polyester remains high in China, which explains why dye-sublimation printing has maintained its dominance, but are we seeing the beginnings of a shift away from sublimation transfer to direct-to-fabric printing?

Dye-sublimation transfer printing quickly captured market share years ago due to its simple process. However, as market demands for quality have risen, its drawbacks have gradually become apparent. Meanwhile, the maturation of disperse direct-to-fabric technology and declining costs have led more enterprises to switch to direct-to-fabric digital printing.

Dye-sublimation transfer printing has never replaced traditional processes in conventional printing factories, and the key lies in production efficiency and large-scale adaptability: limited by energy consumption and precision loss in the transfer step, it cannot meet the efficiency and stability requirements of large-scale continuous production. Additionally, its pre- and post-processes still rely on traditional printing factories. For traditional enterprises, dye-sublimation printing is more akin to the printing industry than textile printing: it uses different dyes from traditional disperse printing, resulting in significant process incompatibilities, making production line integration difficult.

In contrast, disperse direct-to-fabric technology prints ink directly onto fabrics without transfer paper, eliminating the transfer step and reducing material and energy consumption. Single-pass direct-to-fabric technology, with its higher production speed, lower energy consumption per unit and shorter process flow, is gradually becoming the core path for polyester printing upgrades. Its ability to avoid plate making and switch patterns instantly not only aligns with the trend of flexible supply chains but also drives factories to shift from “production-driven sales” to “demand-driven production” – truly unifying green manufacturing and business agility.

Many Chinese print service providers have realised the large-scale application of single-pass disperse direct-to-fabric technology, which is now being demonstrated in industrial clusters in Zhejiang and Jiangsu provinces. By 2025, installations of single-pass disperse direct-to-fabric equipment will continue to rise: the most active customer has purchased four units cumulatively, and the technology’s production line stability and printing quality have gained widespread market recognition.

11. What substrates can you print on with your direct-to-fabric printers? And which are the most popular fibre types among your customers?

Hiink’s direct-to-fabric printers are compatible with a wide range of materials, including natural fibre fabrics such as cotton, viscose, modal and Tencel; polyester fabrics such as huayao (a textured polyester fabric), chiffon, georgette, crepe de chine and brushed fabric; as well as both narrow- and wide-width blended fabrics, for which demand is steadily increasing. Among customers, natural fibres like cotton and viscose, along with polyester, remain the most popular fabric types.

12. Looking ahead, what are your priorities for supporting the growth of digital textile printing in China and globally?

Hiink’s priorities centre on strengthening its core product advantages by maintaining the leading position of the Hiink Kun series while continuously optimising its performance. We are also expanding our application processes by developing new methods, such as acid and vat dye printing, and enhancing the R&D and refinement of its supporting software ecosystems.

Through ongoing development, Hiink aims to further reduce the overall cost of digital printing and drive the industry’s full transition from traditional to digital production. At the same time, it is deepening market penetration by leveraging diverse domestic application scenarios to accelerate the development of inks compatible with a wide range of fibres and to optimise process matching – broadening its reach in high-end apparel, home textiles and other sectors.

Hiink is also enriching its product lines by creating new equipment types in line with emerging market trends, such as intelligent dyeing equipment, to meet the expanding and increasingly diverse needs of the industry.

However, Hiink is looking overseas too, focusing on countries and regions with mature traditional printing industrial chains, such as India, Pakistan, Bangladesh, Turkey and Southeast Asian nations. These regions are seeing steady growth in demand for mid-to-high-end digital printing equipment: as their textile industries face increasing environmental pressures and demand for flexible production, traditional printing enterprises are actively seeking to upgrade to digital technology.

Hiink helps customers achieve a smooth transition from traditional to digital printing through localised service teams and technical support – providing on-site training, maintenance and process optimisation. These markets not only offer large growth potential but also align with Hiink’s strengths in cost-effective, high-stability digital printing solutions.

13. Due to global economic volatility, are you concerned about a market slowdown or market saturation in China or abroad. What is Hiink doing to prepare for such possibilities?

Global economic volatility has indeed brought uncertainties, but digital printing, with its advantages of flexibility, small-batch production and fast delivery, is well-aligned with current changes to market demand. Textiles are daily necessities, so demand for their renewal remains constant; in fields like personalisation and fast fashion, digital printing demonstrates irreplaceable competitiveness. While order cycles may experience short-term fluctuations due to economic conditions and design trends, overall demand remains on an upward trajectory.

Orders in the Chinese market are gradually shifting overseas, but this process has not weakened domestic industrial vitality. Instead, it has pushed enterprises to accelerate technological upgrading and increase value addition.

To prepare for potential risks, Hiink is taking the following measures:

- Enhancing R&D capabilities: Increasing investment in core technologies (e.g., print head optimisation, ink formulation, intelligent control systems) to maintain technological leadership.

- Optimising supply chains: Streamlining supply chain management to reduce costs and improve resilience against component shortages or price fluctuations.

- Deepening global services: Expanding the global service network to provide faster, more localised support for overseas customers.

- Exploring emerging markets: Actively tapping into emerging markets (e.g., Southeast Asia, the Middle East, South America) to promote equipment exports and localised cooperation, building a more diversified and stable global market structure.

While global economic volatility has brought uncertainties, we believe challenges and opportunities coexist. The resilience and rapid responsiveness of the Chinese market provide a solid foundation for us, while demand for sustainable production and flexible supply chains in overseas emerging markets continues to grow.

Hiink remains focused on technological innovation and customer service, helping customers enhance competitiveness through intelligent solutions. We believe the future of digital textile printing lies in the deep integration of efficiency, environmental friendliness and customisation. To this end, we are increasing R&D investment in AI-driven colour management and automated production processes, while expanding in Southeast Asia, the Middle East and South America. Hiink is also actively seeking strategic alliances with more regional partners to meet localised needs in different markets.

To see Hiink’s digital textile printing solutions up close and to learn more about how they can benefit your business, visit the company at ITMA Asia+CITME in Hall 6, Stand B302. The show runs from 28-31 October.

Have your say. Join the conversation and follow us on LinkedIn