The WTiN Intelligence: Digital Textiles channel continues to provide insight into a unique and fast-moving industry that consistently changes and grows as key regional markets mature and newer markets start to develop. The latest round of data, which shows industry findings from 2017, continues to surprise, with higher-than-average growth rates and the start of some unusual trends being seen.

The digital textile industry continued to grow globally through 2016, with machinery sales helping to push the market above 1.5 billion sq m of digitally printed fabric globally. The largest global markets of China, Italy and Turkey dominate, with steady growth rates seen in these large markets, despite a forecast of slowing growth, while other large markets such as the US and India continued to grow on a global scale.

The impact of ITMA in 2015 and large Asian shows in 2016 proved important to the industry, with not only new technologies being brought to the market, but also increasing the awareness of the technology within the wider textile industry. The impact these events had was certainly important, with increased levels of high-value and industrial-scale machinery sales seen throughout 2016 from many different global markets.

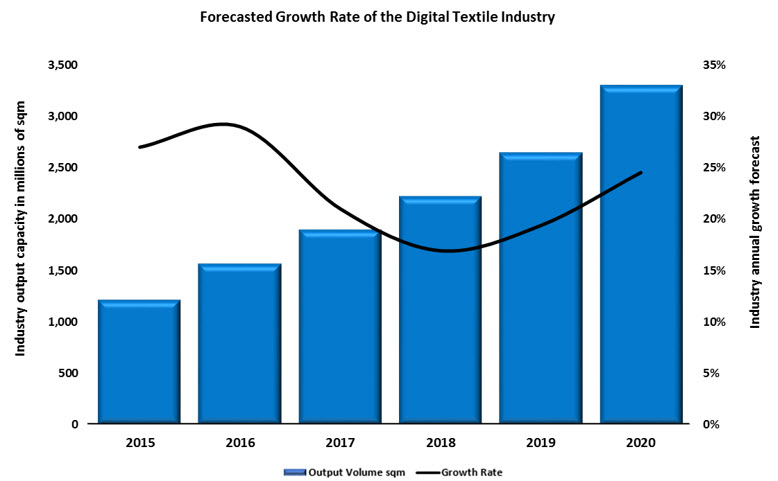

Thanks to stronger-than-expected performances in some of the large global markets and high levels of growth in new and emerging textile economies, the full year showed an uplift in output of 29%, higher than the previously forecast 22%, thanks to new industrial activity. Where we had predicted to see certain maturing markets reassessing demand and lower sales figures, it appears that increased competition within the market and more competitive pricing has helped boost the demand and lessen such impacts. Alongside this, developments in smaller niche markets such as Soft Signage and Pigment printing have helped drive new demand in markets that had previously underperformed. Developing markets such as Vietnam and Mexico that although still small, have also helped compensate for any potential drop from larger markets, with high levels of growth of up 60% witnessed in certain global markets as investment increased through 2016.

Aside from the output increases, global sales in terms of machinery have also increased. An uplift of 18% in installations was seen globally through 2016, pushing the number of dedicated digital textile printers in operation above 35,000 for the first time. While the overriding majority of such machines still operate at the lower end of the market, we saw an uplift of 34% for high-volume printers – those printing above 50 sq m per hour at production quality. This represents nearly 1,200 new units during the year, a clear indication that this industry still has plenty of room to grow – particularly within the higher-value segments, as order lengths increase and large brands and retailers start to adopt digital workflows into their production chains.

The disparity between output uplift and installation growth indicates a positive trend that we have seen across the digital textile industry for many years. As the market has developed from the early days of companies purchasing printers to handle sampling or specific segments, we have seen the demands made on the machinery increase. In today’s market, we are seeing much larger order rates as costs become competitive, but also the quality that digital provides now also offers a competitive advantage compared to traditional screen or rotary technologies.

With digital becoming much more widely known and used within the textiles industry, companies that have older printers are looking to purchase faster and more reliable machines, while those entering the market for the first time are more willing to invest larger amounts than ever before as the technology becomes less of a financial risk. This means that in general the volume of output capable of being printed by the average new printer entering the market is up to 100% more than five years ago. So, while the numbers of physical installations remain lower than the output figures, the value invested into the industry only continues to grow.

It is also important, however, is to keep in mind the bigger picture. Our figures indicate that digital textile printing still only accounts for roughly 5% of globally printed textiles, despite all the high growth and a combination of issues remaining within the industry limiting its potential. The first is hard to get around and relates to economies of scale. While the industry still has a heavy concentration of large orders, digital will only make sense in today’s economies for a proportion of the printed market – a figure that we still estimate to be around 10%, but growing all the time.

Some other key restrictions are easier to overcome, although will still take investment and work. When we talk to designers in today’s market, there is still clearly a knowledge gap on what digital allows and the types of designs and colours that can now be produced using the technology. Even if education of this key demographic increases and they embrace what the new technology allows, there are purchasing departments and other teams that still have very little knowledge of the technology. Large companies are often slow moving when it comes to supply chains, and for many retailers and brands they have complicated processes that make it difficult to engage with new suppliers. This means the industry needs to make the benefits of digital even more compelling to not only the designers, but also those at all levels of the apparel supply chain to help speed up adoption.

Regional developments

At a regional level, the industry continues to change. While Asia and Europe remain the two largest global regions, the industry continues to show signs of high growth and development in newer and smaller markets. From an output point of view, the 2016 data showed that Western Europe saw roughly 34% of the global output of digitally printed textiles produced in countries located in this region, while Asia was only slightly larger at 34%.

While the output volumes are similar, the unit installations are extremely different. Asia has over double the number of physical installations with a much lower output capacity per machine, due to the nature of the economies and the underdeveloped nature of some of the markets in this region. These developing markets also help to explain why the growth rate in Asia remains consistently higher than in Western Europe, with an uplift of 29% from the Asian market compared to just 20% in Western Europe.

Aside from these two large markets, we have seen a lot of other interesting activity during 2016. The Middle Eastern market continues to provide high-growth opportunities, thanks to high levels of new investment over the last year. While the overall size of this regional market is smaller compared to the likes of Asia and Europe, it has quickly grown to rival the Southern America. While Soft Signage printing is a large and an important part of this region, over the last year a huge part of the growth has come from more traditional textile areas thanks to new investment in higher-end technology. Countries such as Iran and Israel have recently seen renewed interest in the digital side of the textile market and, thanks to pre-existing textile industries, the size of the investments tend to be larger than we see in other areas of the Middle East.

Aside from the Middle East, both North America and Eastern Europe have seen strong growth over the last year. The two regions have seen very different trends due to the size of the companies operating in these areas, but also the type of end customer they are focused on. If we look at Eastern Europe, while output and the install base have increased by 36% and 26% respectively, the majority of new activity has been around smaller lower-value printers. This is not to say we have not seen higher-value investments over the year but, with a large number of smaller businesses looking to expand into both digital graphics printing and more traditional textile markets, for many we are seeing the first exploratory purchase and therefore we can expect the values to be lower. These markets are also, in the main, looking to supply the wider European market, which already has a large base of high-volume printers spread across the markets, making for high levels of competition and restraining large-scale purchases until established supply chains created.

The North American market, on the other hand, has seen similar growth levels at a top line but with large amounts of new industrial scale activity seen alongside lower-value installations. This shift towards higher volumes of production, from a capacity point of view at least, indicates that large businesses in the US are now looking at digital textile printing as a viable long-term business opportunity. While most of the North American market still is focused on niche textile areas such as carpets, home crafting, sportswear and soft signage, the scale of these markets in the US means we see high and industrial scale printers being installed to supply the quickly growing demand.

Sublimation printing remains incredibly important to this region, with nearly half of all output produced on sublimation-based printers. Going forward, we expect sublimation printing will be one of the early success stories in this region, helping to boost both high and industrial speed growth in the short-term. If the industry changes and we see increased automation upstream from the printing side, the US could see further digital textile growth as mainstream clothing production also begins to be located closer and closer to end users.

![]()

Unfortunately, not all global regions saw such positive outcomes in 2016. The large market that already exists in South America saw much lower levels of activity than in previous years. Large markets such as Brazil continued to underperform, and the only truly positive areas of activity came from the relatively new markets in Ecuador, Columbia and countries towards the Middle Americas. The majority of this growth was based around the ever-growing area of sublimation printing, thanks to large US sports retailers firmly embedding their more customised production supply chains in this region. This area continues to grow and, unless these US companies bring the manufacturing even closer to the end-user market, these countries and the companies already established there are likely to continue to grow.

The African and Oceania regions remain small, although growth figures are climbing, with levels of output growing by 37% and 31% in 2016. These markets still hold potential for future growth but, until we see more in the way of a traditional textile industry in Africa, it will be difficult for high levels of high-value growth. The South African market continues to lead with high levels of sublimation printing used for a combination of sportswear and more general apparel. Judging by current orders, the South African industry looks to supply the majority of Southern and Middle African demand, although other pockets of growth are slowly seen in the region.

From a regional point of view, we expect the North American and Asian markets to continue to provide high levels of opportunity across the board for manufacturers and suppliers for the short-term, thanks to higher levels of high-value machinery sales. European growth is still expected to be stable, but with lower levels seen in the coming years, unless the industry sees major changes form technology point of view. In a similar sense, the South American market looks set to remain tough in the coming years, with economic policies and situations making it difficult to see high levels of new machinery investment taking place. Other regions globally are expected to see industry growth at similar levels to the global average, with niche markets helping to maintain steady increases and opportunities for development.

Pricing

From a pricing point of view, the industry continues to evolve. Last year saw great polarisation from the market place, if we look at machinery pricing from an output point of view. Both the lowest segment of machinery under $10k and the highest segment of that over $750k saw similar growth rates above 40%. This can be explained partly because the expectation from those looking at lower-end options is now higher and, while pricing may not have dropped much, a customer can now expect a lot more in terms of productivity for a similar-costing machine than five years ago.

While we do still see some low-end printers only capable of printing at 20 sq m per hour, the vast majority of models on today’s market are capable of production speeds of at least 30 sq m per hour, and the customer expects this capability. Not only this, but expectation is now higher, as low-end printers should require much less maintenance and down time. So, higher volumes can be produced for running machines over extended periods of time. Previously, such requirements could only be expected from printers costing at least $20k, possibly up to $50k, hence the increase in output from lower-priced models.

The increase in output from those printers priced over $750k mostly came from the industrial segment of the market during 2016, thanks to both new and existing models in the industry. 2016 seemed to be the year that many companies who had been looking at high-value printers for a number of years finally purchased and installed printers, after spending much of 2015 assessing the market and establishing the sale with the manufacture. Models at these price points have much longer sales pipelines as would be expected, and therefore installations can lag significantly behind demand – which is what we suspect has happened in the 2016 market.

Sublimation

The sublimation area of the market continues to be important for the digital textile industry, and since we started looking at this area of the industry, specifically at the beginning of 2016, we have begun to learn more about the dynamics involved. While traditional sublimation printers operating within the industry are based around traditional paper printers, we have increasingly seen models enter the textiles market that have been built specifically with the textiles market in mind. This means that not only are the values of such printers sold into the industry increasing, but also the handling volumes are rising, and features such as super-wide capabilities are being seen. Traditionally, paper rolls are not made at such widths, so this means specialist suppliers are needed to enable printing to take place.

Print heads

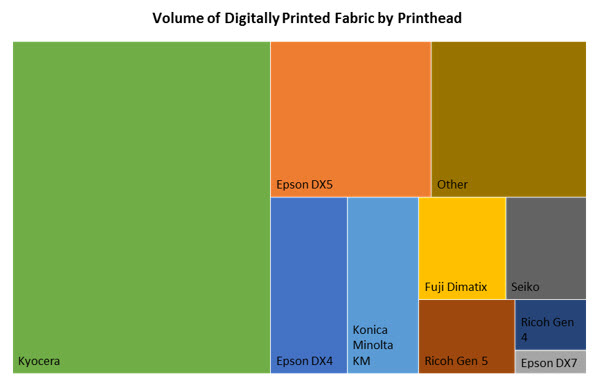

The area of print heads continues to be interesting for the industry, particularly as we are seeing the competition to sell new printers quickly heat up as the industry grows. This means that manufacturers are always looking to differentiate their models, and the type of print head installed in a machine can show an obvious difference to a buyer. Different print heads within the industry are quickly gaining reputations for being particularly well-suited to certain types of textile printing.

During 2016, we saw an introduction of new models available for manufacturers to use within their machines, helping to create further changes to the shape of the industry. Over the course of the last year, we have seen a significant shift away from older models that we would traditionally associate with first-generation models, and low-speed sublimation printers. The well-established Epson DX4 print head – widely used in both Japanese and Chinese models across the world – saw little in the way of new sales. Instead, manufacturers that have access to Epson print heads, which is a much more select group than a few years ago, have focused on the newer Epson DX5 and increasingly more so through 2016. While both these models have been in use for several years, we are starting to see them more commonly used in textile-focused printers instead of in the Solvent market, where they are already common. In particular, the Epson DX7 model has seen an increase in output of over 100% in 2016 alone.

It’s a similar situation if we look at another commonly found print-head model, the Ricoh Gen4. This older model has seen slight decline due to models using it reaching the end of their life. Instead, its replacement, the Ricoh Gen5, has seen substantial growth over the year, of 54%. Despite steady sales of this model, with the increase in competition and substantial upgrades in capability from newer models, we would expect to see either a new launch from Ricoh over the next 12 months or a gradual decline in growth, as newer, dedicated textile print heads move ahead, such is the speed of activity within this area of the market. This model remains popular for Korean manufacturers and increasingly others from Asian markets.

While the Kyocera models still see growth and remain the market leaders thanks to dominance in High speed market leading printers, it will be interesting to see how this model develops over the next 18 months. Not only do we see increasing high-volume Epson models doing well, but printers using Fuji and Konica Minolta models are also seeing high-growth levels from competing high-volume printers and will further put pressure on the established and successful Kyocera based printers.

Alongside this, in 2016 we also saw the announcement of a new textile-focused head from Xaar, the market leader in Ceramic printing. We expect that this model, which has been under development for four years and is being tested with an OEM partner, could well aim to compete and impact of the dominance the Kyocera print-head range has enjoyed for a number of years. By the end of 2018, the print head market configuration could look very different to that of today, and is an interesting area to watch going forward.

One of the big factors that affects the price of a digital textile printer is the print-head component. Despite increased competition, we have not seen a great change in the price of this component over the last five years – which has in turn made the cost of the overall printer fairly stable. The high costs are why some large-scale printers have not been keen to enter the digital market, and is therefore a limiting factor in the industry’s development. While the new models entering the industry will certainly only help in driving down costs, a major development may shortly be seen in the area of print heads that could impact the costs involved and help change the shape of the industry and boost growth. This development is MEMS (micro-elector-mechanical) manufacturing, which allows for a complete head to be made to be made for a reduced cost. While the technology has been used by companies such as HP and Canon, we are now seeing companies already involved in the textile industry such as Epson and Fuji Dimatix using the technology. Not only can costs be brought down by using such technology, but also MEMS-produced heads are known to have high durability and reliability alongside resolution improvements. These changes, coupled with a cheaper unit cost, could drastically improve the overall performance of textile-focused digital printers, while at the same time making the overall costs involved lower.

Forecast growth

Long-term, the growth potential within the market remains one of the highest in both the textiles and digital printing industries thanks to two factors. First is the head room left within the industry, with over 95% of printed textiles still capable of being printed digitally in a theoretical sense. The other is the level of innovation and development that we are seeing in the industry today. The implications of not only increasing productivity levels from digital textile printers, but also the early adoption in various businesses of a more flexible and distributed manufacturing base, mean we are still only at the edge of seeing how important this technology can be for the industry.

The increased industrial scale activity that we saw over 2016 and the continued growth seen in large markets such as China means that our forecasts have risen slightly on the back of such positive movement. Certainly, when we look long-term our early CAGR of 17% looks to be a little weak and realistic expectations are more likely to be at 20% for the period until 2020.

The Western market, where changing retail trends are shaking up the apparel manufacturing chain, continue to play a big part in this industry’s growth, but the changing policies in Asian markets around manufacturing standards are also having a big effect and boosting growth. Those traditional manufacturers that have an eye on the future direction of the industry are already looking to invest in digital and get ahead of the curve, or are looking to move to new and more relaxed markets. Both these options require investment and the combination of activity in both the East and West looks set to allow for long-term growth. The trend is clear in both geographical areas that high-value machinery is the way forward, and while we may not necessarily see digital printers produce the volume that traditional rotary machines do, we do not expect the demand to push for such levels.

While fixed-head printers continue to have success, we are still seeing multiple high-volume scanning head units bought by companies. Whether this is to allow for greater flexibility or due to costs we are unsure, but at this point this type of model appears to be sufficient for the majority of the market. If the new industrial trend of Industry 4.0 continues, in the long-term the industry may not need such high-volume units, or at least very few. Instead, the future could see much larger numbers of high-volume printers spread out globally, all printing at defined qualities for local markets in a much more automated and reactive work flow.

In the short-term though, expectations remain high. We do expect to see further industrial and high-speed printer sales through 2017, although the numbers are expected to be slightly lower from those selling printers to the highest end of the industry. The base of low end printers is expected to expand but with gradual increases in both price point and production at an average level. This will mean that although output is forecast to rise by around 21% for the full year, in actual unit terms the forecast is lower at around 15%.

The soft signage market is expected to continue to perform well, with increasing widths an important feature of sales through 2017 and onwards. Indicators from the market point to more specialist suppliers bring super-wide width substrates to the market, helping to increase the availability, but also lower the price of this key ingredient. In addition, we expect to see production volumes of new printers entering this area of the market increase, meaning an imbalance between output uplift and unit sales will also be seen in this area. Output could well increase by as much as 25% in 2017, thanks to new demand in smaller markets, although unit sales could well see growth below the 10% mark. This means that hardware providers will continue to fight for both market share presence and sales, while those supplying inks and substrates continue to have the best of the industry in terms of growth.

From a country point of view, 2017 looks similar to that of 2016, with a widespread of high opportunity markets. Eastern Europe is expected to see high growth levels, although many of the markets other than Poland are still small and under-developed. Mid-level machinery is expected to do well in this area of the next few years, with the long-term demand not yet in place to support industrial-scale investment. Countries highlighted previously included Bulgaria and Romania, both countries are within the EU economic zone and have low labour rates in comparison to the majority of Europe at present.

Activity in the Middle East also continue to grow but, realistically, we do not expect much in the way of large-scale production other than in niche markets such as soft signage and graphics. If we look towards Asia, Vietnam and Bangladesh still have potential but, with more traditional printing technologies also seeing growth in these countries, it will be interesting to see if digital printing wins the investment it needs for large-scale growth. On the other hand, we still see large growth levels in India and China, with both markets expected to perform better than the global average in 2017 and continue to dominate the industry into the future.

The digital textile industry continues to develop and evolve, with areas such as Pigment printing still not seeing the success they had been touted to see. These potentially high-growth areas still evade the majority of the market, with only dedicated businesses willing to invest the time and money to work out the nuances involved when printing with pigments digitally. As time goes on, we are seeing more and more businesses have successes in these areas, but the industry ideally needs to see breakthroughs take place while the eyes of the industry are still on digital textile printing – a segment that on a textile industry scale remains a small and niche area of the industry, but one with very high potential.

RELATED ARTICLES

-

Innovation & differentiation in textile printing

- Madelaine Thomas

- WTiN

-

Futureproof process weathers volatile sentiment

- Joseph Link

- WTiN

-

AI and the future of textile print design

- Joseph Link

- WTiN