Justin Huang, president of the Taiwan Textile Federation, discusses the trend of the Taiwanese textile industry towards value-added functional textiles.

Taiwan textile industry overview

During Taiwan’s development in the 1960s and 1980s, which was considered an ‘economic miracle’, the textile sector was one of the three most important industries that contributed to the country’s expansion. And today, the textile industry remains a strategically important sector contributing to the country’s development. As of 2016, there were around 4,300 textiles and clothing factories in Taiwan, employing around 140,000 people [1].

Taiwan is an export-oriented country and, for a number of decades, international trade has been an important driver of the country’s economic growth. In 2015, the textile industry was the third-highest foreign exchange earner in Taiwan [2] and constituted for around 3.9% of total Taiwanese exports [3]. The export value makes up around 75% of the total textile and apparel production in the last 10 years [4]. This makes Taiwan the ninth-largest textile exporter worldwide [5]. In 2015, total exports of Taiwanese textiles reached a value of US$10.8bn, whereas import value was US$3.5bn, bringing a trade surplus of US$7.3bn. As the industry is a high contributor to the country’s economic growth and is strongly focused on exports, it strives to develop export competitiveness and promote it in the global market.

Taiwan’s textile industry offers a complete supply chain, covering upstream, midstream and downstream manufacturing. As Taiwan has a strong petrochemical industry and insignificant domestic natural fibres, the industry has primarily benefited from manufacturing synthetic fibres derived from petrochemicals. Notably, high-petrochemical industry capabilities enable sourcing of raw materials locally, which means lower costs and shorter lead times. This ultimately results in better flexibility and thereby increases the competitiveness of Taiwan’s textile sector in this area. Although companies strive to combine the advantages of natural fibres, manmade fibres still play an important role in new product development.

Looking at exports by product type, fabrics account for the largest share of exported items, with a 68% share. This is followed by yarn, with a 14% share. Fibres are estimated to constitute an 8% export share, followed by apparel and clothing with 6% and miscellaneous textiles with 4% [6].

Source: Taiwan Excellence, 2017

As for the export markets, as of 2015, the largest importer of Taiwanese textiles is Vietnam and mainland China, with 19.8% and 19% of total export value respectively [7]. The third-largest exporting destination is the US, which accounts for 8.1% of the total export value.

European Union (28) countries account for 4.5% of total export value. Taiwan’s textile industry hopes to further expand in Europe. This can be seen through signing an Addendum Agreement to the Memorandum of Understanding (MoU) at Titas event (Taipei Innovative Textile Application Show) – the annual functional fabrics trade fair in Taipei. The agreement, effective in 2015, aims to strengthen collaboration between Taiwan and the Czech Republic. Huang says: “Czech is a well-known industrial country. Even though Czech companies face fierce competition from Germany, Italy, China and Turkey, they are still surviving which means that they have something right in their hand.” He continues: “Maybe in the future, we might have some collaboration with other mid-sized countries in Europe, such as the Netherlands or Austria.”

Development towards functional and high-value added textiles

A growing focus of the Taiwanese textile industry is functional and high-value added textiles. This can be seen through the organisation of the Titas (Taipei Innovative Textile Application) exhibition, which comprises companies offering high-tech and innovative textiles. Huang says: “I think right now when we look at Titas, it can be recognised as a professional platform for functional textiles or innovative textiles. It’s not a large trade event, but it has a very strong focus on these fields. And I think this platform, this achievement, is no doubt jointly made by all the Taiwanese industries – upstream, midstream and downstream.”

Based on statistics from the Taiwan Textile Research Institute, around 70% of functional fabrics globally are sourced from Taiwan [8], and the sector increasingly develops its innovation and R&D capabilities. It is claimed that the average added value of functional textiles has been improved by 17% through continuous transition, innovation and R&D [9].

Importance of sports and outdoor application areas

Key application areas that the industry strongly focuses on in terms of added value include sportwear and outdoor products. Taiwan makes up a considerable part of the global sportswear and outdoor products’ supply chain. According to TTRI, around 70-80% of outdoor brands have bought functional fabrics from Taiwan [10]. For example, around 40% of Nike’s functional fabric comes from Taiwan [11]. This makes international sportswear and outdoor brands important customers for Taiwanese textile companies. For instance, as of 2015, the segment claims over 80% of Feng Tay’s revenue, 10% of Eclat Textile’s revenue, and 22% comes from Nike [12].

The Taiwanese sports and outdoor textiles industry is relatively competitive in technological developments globally. Looking at ISPO Munich 2016 Textrends award, Taiwanese companies’ products accounted for 37% of all the presented innovative products.

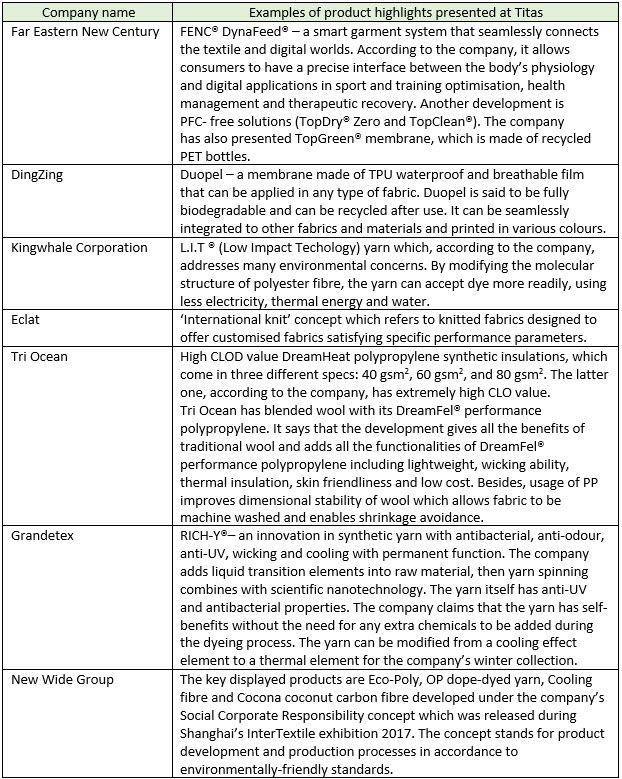

The recent edition of Titas (held in October 2017) saw many textile companies present products for sport and outdoor applications.

Examples of some of these developments presented at the exhibition can be seen in the table below:

The Taiwanese government is focused on developing Taiwan into an important R&D and production base for the functional and technical textiles industry. Huang says: “The government is subsidising the Taiwan Textile Research Institute (TTRI) for technology R&D and they are also encouraging textile mills to gather results from the institute.” TTRI has been assisting Taiwanese companies in enhancing competitiveness in the global industry. It helps textile businesses with the R&D of textile-related technology and information. It also assists in design, planning, evaluation and certification for textile fibres, and its relevant products provide required training as well. However, there is a strict regulation that states all the developments need to remain in Taiwan. Huang says: “Anything transferred from the research institute has to be manufactured in Taiwan. It cannot be manufactured in other countries for a certain period of time, depending on the technology.”

Taiwan’s textile industry focuses on enhancing the image of Taiwanese products and widening the market differentiation between Taiwan’s developments and lower value-added products coming from other developing countries in Asia. To offer a higher level of quality assurance in high added-value textile products, the Taiwanese textile industry introduced the Taiwan Functional Textiles Certification System and label in 2000. In addition, Taiwan Textile Federation, as commissioned by the Bureau of Foreign Trade, Ministry of Economic Affairs, introduced its Textile Export Promotion Project which aims to help expand the Taiwan textile industry worldwide. Its implementation also contributes to improving the sector’s image in the global market. Through rigorous implementation of related measures under the Textile Export Promotion Project, only premium textiles exporters are selected to promote their products.

A relatively strong focus on quality assurance attracts large retail companies operating in mid-end and high-end markets. Anta – one of the key players in the Chinese sportswear market, whose revenue in 2016 grew 20% and reached the value of RMB13,345.8m, compared to RMB 11,125.9m revenue in 2015 [13], is a great example of how the company improved its product quality and increased competitiveness once it started sourcing from Taiwan. According to Huang, at the beginning, Anta was struggling in the Chinese retail market to compete with big international brands such as Nike, Adidas and Columbia. Its main issue was instable quality of its apparel, which mainly resulted from a sourcing strategy focused on pricing rather than quality. After approaching Taiwan’s New Wide Group who offered to supply materials, the situation changed dramatically. The Taiwanese company offered to provide a long-term system for quality control for filament, yarn, fabrics, dyeing, finishing and apparel making, which avoided further price competition.

Adding value through smart textiles

The Taiwanese functional apparel textiles industry is strongly focused on smart textiles for apparel, which are viewed as one of the key focus areas for the future development of high value-added and innovative products. Taiwan is well known for its strong semi-conductor, high-tech and biomedical industries, which facilitate its growth in the smart textiles market. Huang points out that both the Taiwanese electronic and textile industries are interested in smart textiles that accelerate the sector’s development. He says that around three or four years ago, Taiwanese textile mills started thinking about increasing the value of sportswear products by not only adding functional performance, but also through incorporating electronic technology into apparel. Electronic companies also found it interesting to integrate their technology into textile products as more traditional markets, such as mobile cell phones, were very well covered by Chinese competitors.

In fact, merging technologies originating from different spheres has been quite challenging. Huang notes: “At the beginning it was difficult, because electronic engineers never understand what is going on in textiles. For instance, the measurement systems are not compatible with each other. The electronic industry uses metres, centimetres, millimetres and nanometres, whereas textile companies use denier, so it took quite a long time to get used to with each other’s expertise.”

Given further developments in Big Data and Artificial Intelligence and telecommunication technologies, there are several opportunities to serve consumers in a new way through smart textiles technologies.

Huang says the ageing population is one of the most important factors that is creating opportunities for smart textiles products. Between 2015 and 2030, the size of the global population aged 60 years or over is expected to increase by 56%, from 901 million to 1.4 billion. And by 2050, the number of older people in the world is projected to more than double its size in 2015, reaching almost 2.1 billion [14]. The ageing population means an increasing number of geriatric patients and, ultimately, a growing requirement for medical and nursing care. Huang says: “We can combine textile and technology to find a way to look after elderly people. Seeing a medical practitioner from time-to-time does not give a continuous picture of a patient’s health. The development of smart textiles creates opportunities for real-time close monitoring, leading to better instructions provided by healthcare practitioners.”

In fact, healthcare systems are becoming increasingly advanced in the developed world, but it lags behind developing countries, creating a challenge when it comes to introducing smart textiles to some markets. An interesting example of a Taiwanese business that has capitalised on the ageing population trend and focuses on targeting private consumers is RuenTex. The company has developed a set of five T-shirts that can be linked to mobile phone apps. They can be worn by older people and data can be transmitted to different users so, for example, elderly people can be monitored by their relatives, who can be alerted if anything happens.

Looking forward, key growth prospects for Taiwanese companies in the field of smart textiles are nano-conductive films with sensors to monitor vital signs, and textiles for personal safety and healthcare emphasising stableness and wearing comfort.

Developing environmentally-friendly solutions

Given rising consumer awareness about environmental protection, NOGs activism and increasingly stringent environmental regulations, the Taiwanese textiles industry increasingly focuses on incorporating sustainability into its products and production. Huang says: “Sustainability is the only way for every company in Taiwan, they have to seriously face it and make realistic developments for meeting new goals.” The table above includes some of the developments presented at Titas 2017, which address environmental sustainability.

Notably, technology transferred from the Taiwan Textile Research Institute helps Taiwanese companies to bring sustainability into its products. The Institute’s R&D efforts strongly focus on developing products addressing environmental protection issues. The table below presents some of the focus areas of Taiwan Textile Research Institute addressing sustainability.

The Taiwan Textile Research Institute developments focused on sustainability

References

[1] Taiwan Government Statistics

[2] Taiwan Textile Research Institute Annual Report

[3] Taiwan Textile Federation

[4] Taiwan Textile Federation

[5] WTO

[6] Taiwan Excellence

[7] Taiwan Textile Federation

[8] Taiwan Textile Research Institute

[9] TTRI, 2015 Annual Report

[10] Taiwan Textile Research Institute

[11] Daiwa Capital Markets

[12] Daiwa Capital Markets