The WTiN intelligence: Digital Textiles channel continues to provide insights into a unique and fast-moving industry that consistently changes and grows. Newer markets start to develop while key markets mature in 2017. The latest round of data shows us that the market still has lots of room to grow.

Introduction

The digital textile industry continued to grow globally through 2017, with machinery sales helping to push the market to around 1.9 billion sq m of digitally printed fabric globally. China, Italy, India, Turkey and the US continue to dominate, with steady growth rates in some of these large markets. The output volume of digitally printed fabric in these five countries is 47% of the global volume.

The exhibitions and conferences in 2017 once again proved the importance of the industry, with not only new technologies being brought to the market, but also an increase in the awareness of the technology within the wider textile industry. Digital printing not only delivers advantages in fast production turnaround, lower inventory and endless design possibilities, but it also has a significant impact on the environment compared to the traditional printing. Therefore, we have again seen many new installations in different global markets in 2017.

Thanks to the performances of some large global and emerging markets, the full year showed an uplift in output of 22%, which is, although less than the previous year’s growth, in line with expectations. Some new and emerging markets captured the attention of OEMs in 2017, while some of the established major markets had a more stable year.

We had predicted lower growth figures in mature markets in 2017. However, environmental regulations in China, together with high orders in Turkey, had an impact on digital printing in both those markets. Developing markets such as Pakistan, Bangladesh, Indonesia, which are still small compared to the major markets, became the focus for many OEMs and showed high growth rates that have helped to compensate for the stability of mature markets.

Aside from the output rise, global machinery sales have also increased. An uplift of 11% in new installations was seen globally through 2017, pushing the number of dedicated digital textile printers in operation to above 39,000. While the overriding majority (83%) of printers still operate at the lower end of the market, we saw an uplift of 40% for high-volume printers – those printing above 50 sqm per hour at production quality. The developing technologies for more productive printers and high growth rate of this segment are the reason for the difference between output volume and installation growth rates. Companies are investing in digital technology not only for sampling or specific segments, but also to meet high order rates. Another reason for investing in new technology is that it has less impact on the environment, fewer production costs for short to moderate runs, and less consumption of chemicals/inks. Those are the latest trends in machinery manufacturing.

It is also important to remember the big picture. With digital printing reaching 1.9 billion sqm, its share in total printing industry becomes 5.5% globally. This number not only indicates its penetration into traditional printing by old-technology machines with new ones, or by increasing capacity, but also indicates the arrival of new businesses. We estimate that almost one-third of our figures represent design houses, web-to-print companies or new conventional print houses that have discovered the potential of digital printing and entered the market.

Regional developments

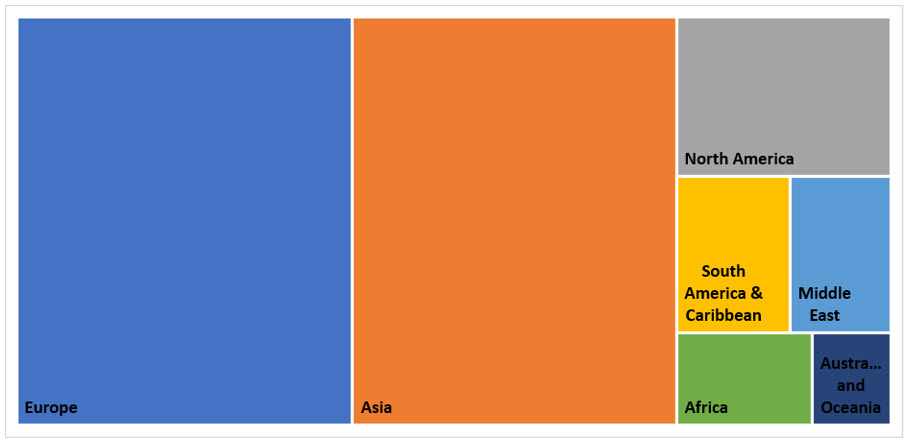

At a regional level, while Asia and Europe remain the two largest global regions, the industry continues to grow both inside and outside of these two regions in smaller markets. From an output point of view, the 2017 data showed that Asia and Europe saw roughly 37% and 38% market shares respectively. Although the output volume of these two regions is very similar, the unit installations are quite different. The number of printers operating in Asia is almost twice as many as in Europe, because of the underdeveloped nature of the markets in this region. However, in particular China has started to invest in high-end machinery, which will show its impact on volume in coming years.

The higher growth rates in markets such as Pakistan, Bangladesh, Vietnam, Sri Lanka and other South & Eastern Asian countries had a significant impact on the region’s growth in 2017. Especially Pakistan has been the fastest-growing market, with a 40% increase in the output volume compared to last year. Some of the commission printing orders of fast fashion brands were moved to East Asian countries because of the high labour cost of China. However, China is still very powerful in the region, having the best quality printing and garment factories. Although we were expecting to see a stable year for China, the environmental protection policy of the Chinese government became a driver of new installations, which led to a rise in annual output capacity of 21%. South Korea is another market in the region, which had a difficult year because the export orders moved to China and other Asian countries.

On the other hand, although Europe has the highest share in terms of printed fabric volume, 2017 has not been quite so good a year for this region. Output and the installed base have increased by 22% and 10% respectively. Most of the European countries saw lower growth rates than the global average. Eastern European countries and Turkey were the drivers of Europe’s growth in 2017. Although the number of new installations was not as high as previous years, Turkey has increased its export orders. Moreover, in Eastern Europe, while Poland and Russia were the biggest markets, we have started to hear more about other countries such as Bulgaria, Romania, Croatia, etc. Most of these countries have started digital printing to meet the export demand of Western European countries for signage and textile businesses are using mostly sublimation transfer technology.

Apart from these two large markets, we have seen a lot of activity in other regions, too. Digital printing technology for the Middle East is a great opportunity, as it requires less water compared to traditional methods. In this region, the UAE is a more signage dominated market, while Saudi Arabia is more focused on fashion, sports and interior decoration. Although Iran is still a very small market in the region, it continues to show very high growth rates. Carpet printing is a niche area in Iran, and we have started to see new installations specific to this application. Investments tend to be larger in these countries, including Iraq, compared to the other areas of the Middle East.

Install base of digital printers by region - 2017

Digitally printed fabric volume by region - 2017

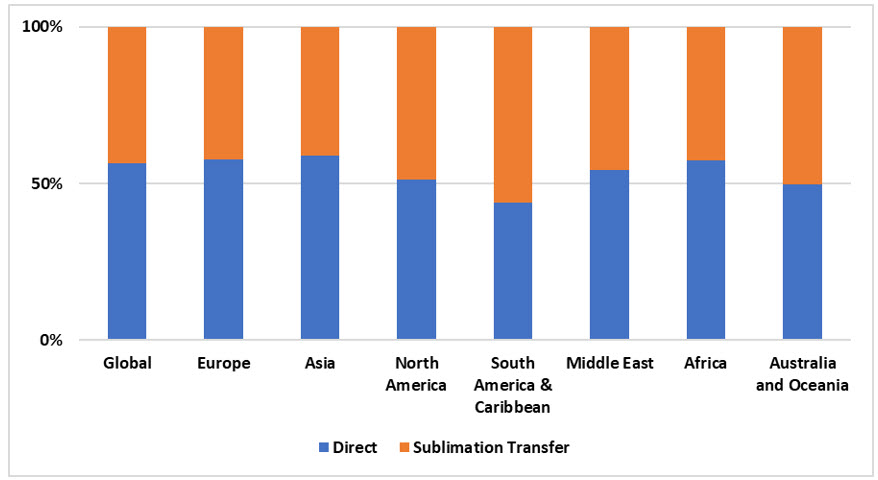

On the other hand, the North American market continues to grow, with large numbers of super-wide signage printers installed in the US in 2017. Many small signage print houses and web-to-print businesses have started to invest in digital printing technology. We have also seen installations of new textile printers for fashion and sportswear applications, as customisation and reshoring become more popular each year. Because of the nature of the applications, sublimation transfer printing is the key technology used in the US, with more than half of the output volume printed by sublimation-based printers.

South America and the Caribbean saw growth rate similar to the global average. Although the Brazilian digital textile market had a difficult 2017, because of its economic and political issues, it is the biggest market in the region. Nevertheless, despite the turbulent background, since August 2017, the market has started slowly to recover its rhythm, which makes expectations higher for the coming years. In 2017, we have seen installations in new markets such as El Salvador and Guatemala. The majority of the investments in the region were in sublimation printing for fashion and sportswear applications. This area is very much affected by US policy. However, currently, it is expected to grow thanks to demand from the large US sports retailers.

African and Oceanian digital textile markets remain small, although these two regions had higher growth rates than the global average. There are two different markets in Oceania: we have seen new super-wide format signage printers installed in Australia, while low-end textile printers with sublimation transfer technology dominates in Indonesia. In the African market, although South Africa has the biggest share, we have seen new installations in Egypt, Morocco and other countries such as Sudan and Ethiopia. These countries use the advantage of their low-cost workforce and present themselves a new alternative to sourcing from Asia. The Egyptian market is expected to grow thanks to the government’s support to make the textile industry strong again. Currently, customers choose to invest in sublimation because of the high prices of cotton-based products and applications.

Pricing

If we look at new machinery installations in terms of their prices, the highest growth rate came from printers that are priced at $50k - $100k, with 30% more new installations compared to 2016. This can be explained as indicating that customers do not go for very slow-end, cheap printers. Instead, they now expect to buy affordable but more productive ones. Nevertheless, big proportion of the total world volume is printed by the high-value printers, priced over $250k. We have seen new industrial scanning printers and single-pass printers entering the market last year. The majority of these printers are operating in European countries and China, using direct printing technology for fashion and home textile applications.

Digitally printed fabric volume by printer price - 2017

Sublimation

Sublimation transfer printing technology continues to be an important area for the digital textile market. As printer prices remain stable, lower costs of sublimation printers and processes, and decreasing ink prices, make this technology more popular. We see this trend particularly in the markets focusing on meeting the fashion and sportswear export demand, such as Turkey and Brazil. Some of the Asian printer manufacturers are planning to introduce their more productive sublimation printers to the western markets in 2018. Installations of super-wide, high-productive printers increased the volume of sublimation printed fabrics by 27% compared to the previous year. Most of the high-speed, super-wide printer installations were seen in the US, China, India and some European countries in 2017.

Digitally printed fabric volume share by printing technology - 2017

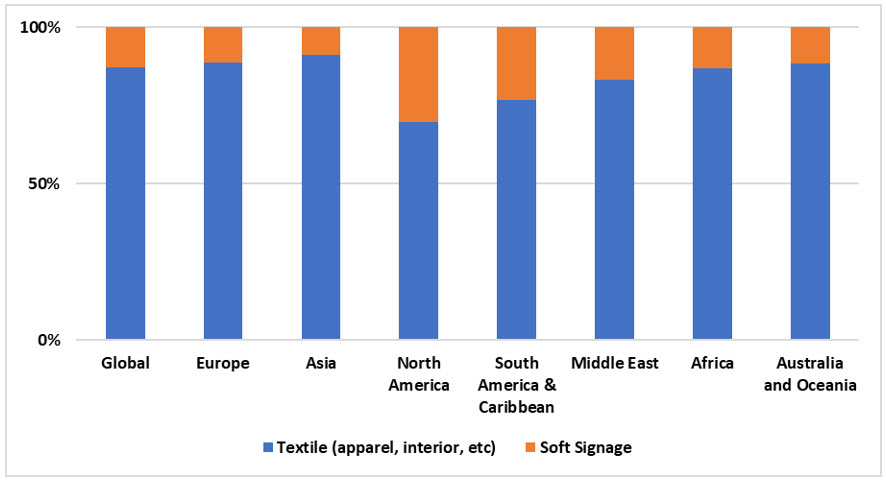

Signage

Signage application in some countries have helped the digital textile market to grow faster in those regions. Globally, the output capacity of soft signage increased 17% compared to the previous year. While some countries print textile products for export markets, signage is used mostly for local demand. Direct printing on mainly polyester fabric for soft signage is growing in many countries, such as the US and UAE, due to the higher number of events and constructions. The US is the biggest market, soft signage accounting for 33% of printed output volume.

Digitally printed fabric volume share by application - 2017

Print heads

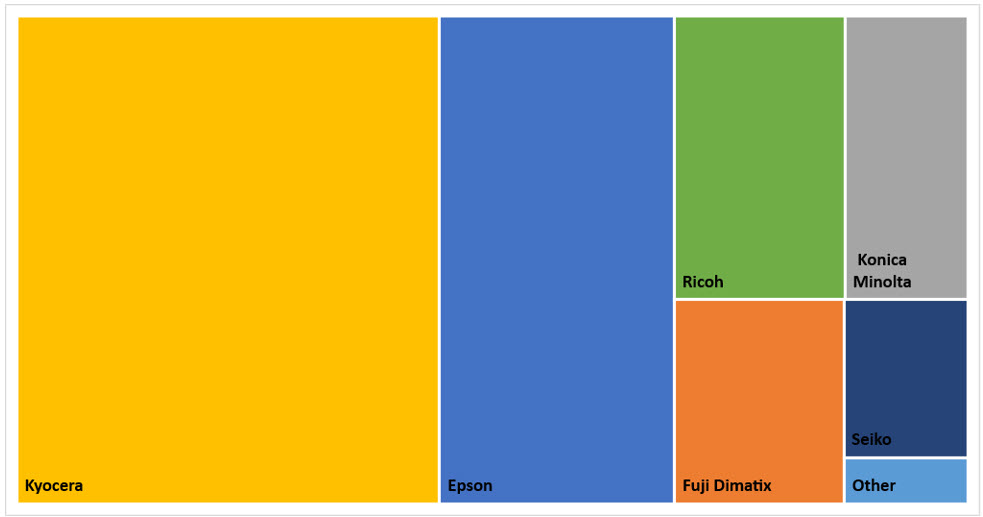

The area of print heads continues to be interesting for the industry, as it is one of the big factors that affect the cost of digital textile printing. Machinery manufacturers introduce new models, or update their current models with new print heads, to differentiate them and offer customers enhanced performance. During 2017, Xaar provided its 1201 print heads to d.gen for its Papyrus 740K sublimation transfer paper printer and began to forge partnerships in the textile industry. When we look at the figures, Epson print heads are still the market leader in terms of installations, as these print heads are used in most sublimation-based printers, and in many Chinese models. However, Kyocera print heads dominate the market in terms of output volume, thanks to the dominance of high-speed segment printers. Moreover, Konica Minolta and Fuji print heads are two other models that have increased their share in 2017.

Digitally printed fabric volume share by print head - 2017

Forecast growth

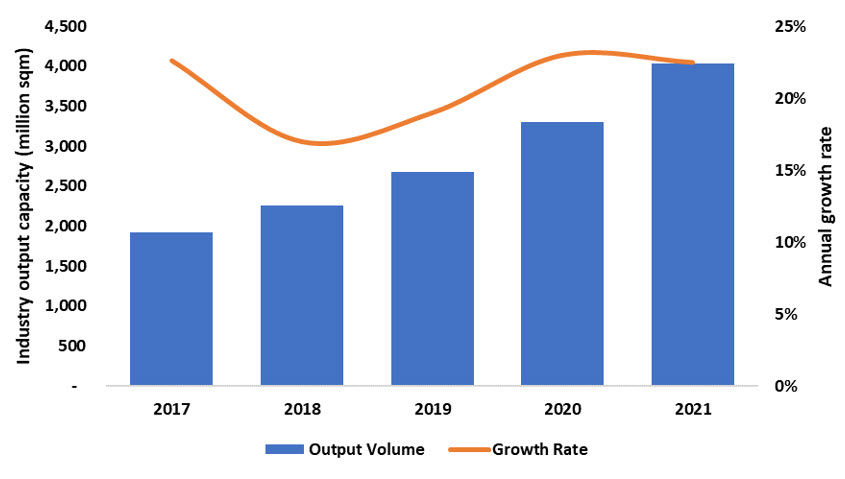

As mentioned in the introduction, 1.9 billion sq m of digitally printed fabric represent only 5.5% of total printed fabrics, which means the other 95% is an opportunity for digital printing technology. From the end-user side, the quality and creative advantages are well-known. And from the technology manufacturers' point of view, we have seen developments in new hardware, software, inks and chemicals every year. All these improvements mean that the future is positive for the industry. In 2017, over 1.9 billion sq m of fabric were digitally printed, and the compound annual growth rate (CAGR) of this global industry is projected to be 20% by volume through the period 2017-2021.

ITMA 2019 will take place in Barcelona in June of next year and manufacturers already getting ready to launch new technologies during this event. 2018 is therefore likely to see moderately lower growth rates and to be a more stable year than 2017, as many investors would prefer to wait and see what ITMA brings.

Global Digital Textile Market Growth Forecast

In the short-term, we do expect to see further industrial and high-speed printer sales, which will increase volume by around 17% and the total installed machinery base by around 10% for 2018. Government support to improve the textile industry in countries such as Russia and Egypt, and governments’ environmental policies in Asian countries, are the drivers of the new investments. It is not only governments that are forcing their manufacturers to reduce their environmental impact, but also global fashion brands are choosing suppliers whose standards help them meet their carbon footprint commitments.

From the regional point of view, we expect to see high levels of opportunity in Asian and North American markets. These two markets have completely different characters, but they are both embracing the technology and are open to high-value machinery investments. The emerging markets, like Pakistan, Bangladesh and Vietnam, will still be the focus for OEMs. Although European growth is expected to be stable, the Turkish market is likely to invest more in the coming years, as the currency has stabilised after a long, two-year period of economic and political instability. We are expecting to see home textile manufacturers invest high-value direct printing technologies.

Cost is a critical factor in the digital printing industry. Companies try to make comparisons to understand the difference in cost between printing a square metre of fabric by digital and traditional routes. High ink prices, especially, are a major concern and we therefore we observe that ink is the most contested area of competition in the industry. In the larger markets, some local manufacturers and Chinese brands are cutting prices and putting pressure on the global brands and OEMs. Pigment inks are perhaps the most popular arena for price and quality competition. We saw a patent published in the US last August, outlining Agfa’s commitment to developing both dye-based and pigment inks for this market. Another patent was recently published for an aqueous inkjet ink set for textiles from RISO Kagaku Corp, which shows their intent to enter the textile market. We will see the effects of these and other similar developments in the coming years.

Additionally, we saw new entry-level hybrid printers that enable the use of two different inks without changing ink systems. These printers would be advantageous for small businesses which print on different types of fabrics. They will need only to swap the fabric roll rather than having to clean out the ink system. Moreover, another hybrid technology enables the combination of inkjet and screen printing in one machine, expanding the available effects.

To sum up, these developments are very positive for the future digital printing industry as they offer different choices for the end users.